The Price Of Bitcoin dropped by $60,000, Yet There Is Still Optimism Due To A Developing Wyckoff Signal

The increased likelihood of an American recession is driving the continued Bitcoin sell-off, but overall, the prognosis is bright.

In the last 24 hours, Bitcoin BTC $52,670 has dropped more than 4% and is already below $60,000. However, based on a developing Wyckoff reaccumulation pattern and growing odds of three rate cuts by the end of 2024, a retest of $74,000 in the upcoming weeks is plausible.

Important Spring Support Is Being Tested By Bitcoin

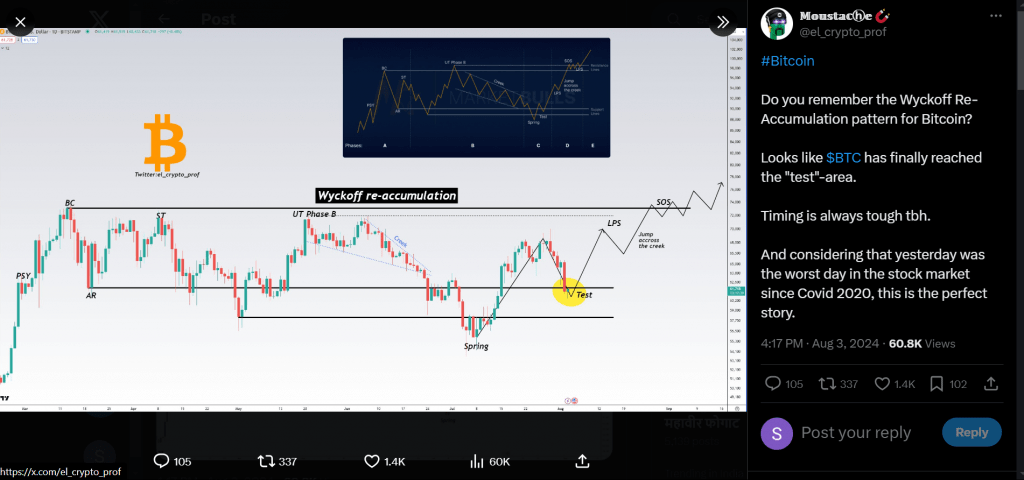

Technically speaking, the Wyckoff reaccumulation pattern indicates periods of accumulation and consolidation following an extended upswing.

Preliminary Supply (PSY), Buying Climax (BC), Automatic Reaction (AR), Secondary Test (ST), Spring Test, Last Point of Support (LPS), and Sign of Strength (SOS) are the nine crucial phases that the price usually goes through in this pattern.

The “Test” phase of Bitcoin’s Wyckoff reaccumulation pattern had begun as of August 4.

According to the chart published by independent analyst Moustache on his X channel, the cryptocurrency is currently challenging its bottom from the Spring phase, which is currently at around $53,400, as support to affirm bullish continuing toward its new Last Point of Support (LPS), which is at about $70,000.

The Wyckoff reaccumulation rule states that when Bitcoin reaches the ninth and last stage, known as the Sign of Strength (SOS), following a retesting of the Wyckoff pattern’s top level of approximately $74,000, a new uptrend cycle will start.

This last phase, which denotes a definite uptrend, shows significant upward movement and market strength.

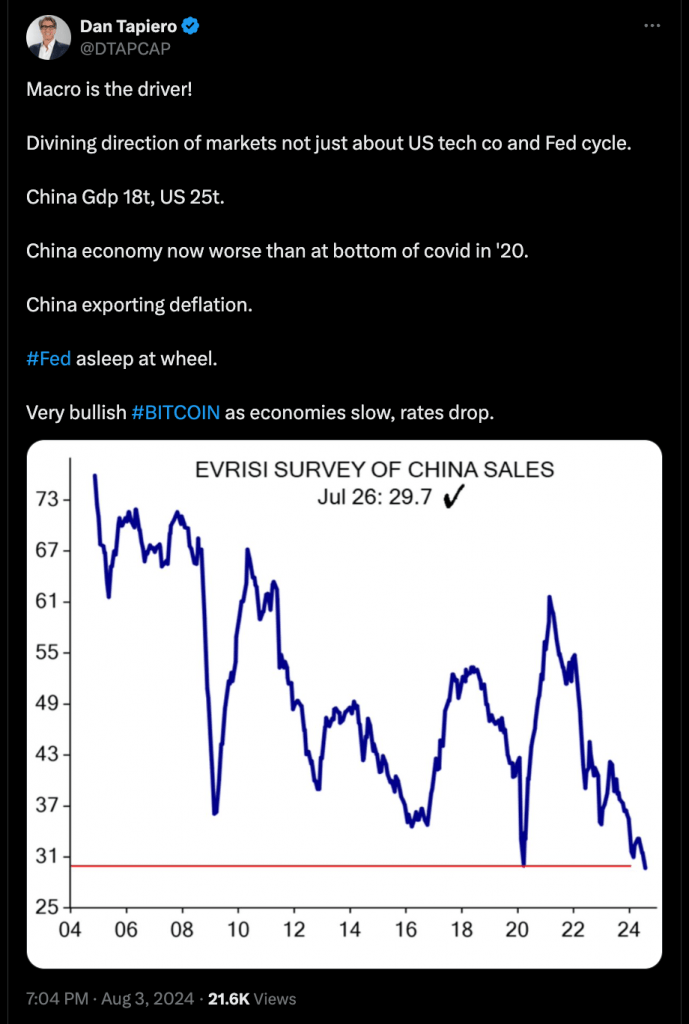

In 2024, Three Rate Reductions Could Occur Due To Recession Threats

Since August 1, when the US reported deteriorating manufacturing activity and unemployment claims reaching an almost one-year high, the price of bitcoin has fallen 10% along with the US stock market. Around $200 million in withdrawals have been made from bitcoin exchange-traded funds (ETF) within the same time frame.

The decrease in Bitcoin is noteworthy because it coincides with growing odds of three rate cuts in 2024 rather than just one. This is a major divergence from the previous year’s pattern, in which crypto markets have often welcomed negative economic data.

The increase in recession alerts following the most recent US jobs report is probably what’s causing this fall

Bitcoin has historically suffered when concerns about a recession have been at their worst. For instance, Bitcoin and the US stock market both experienced falls during the COVID-19 market meltdown in March 2020. Following the Federal Reserve’s implementation of quantitative easing and rate cuts, the price of bitcoin started to rise.

Michael van de Poppe is among the many cryptocurrency analysts who predict a similar price trajectory in the upcoming weeks. Put another way, Bitcoin will have recessionary risks, but it will recover once the Fed lowers interest rates in September.