Bitcoin Reserve Could Significantly Reduce U.S. National Debt by 2049

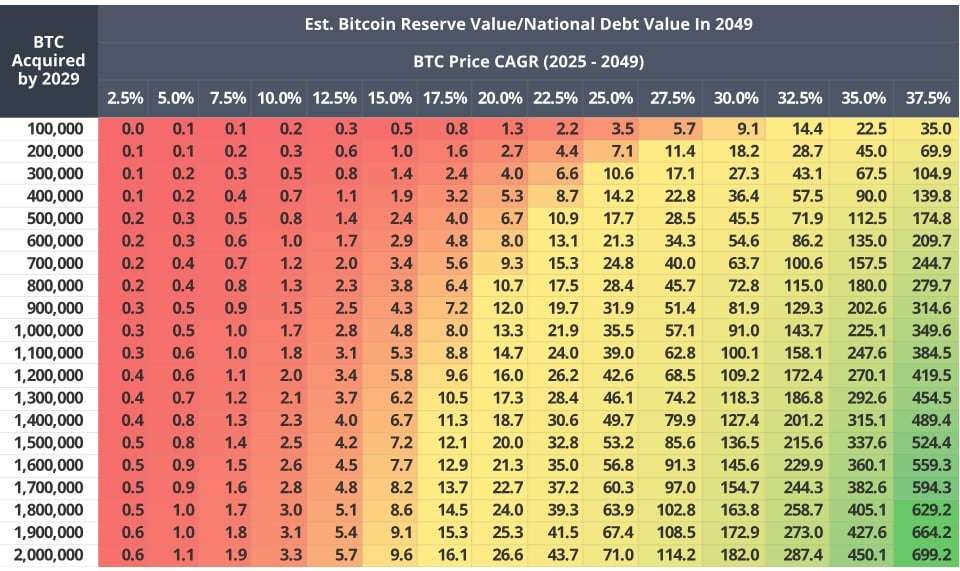

An asset management firm, VanEck, suggests that the United States could reduce its national debt by 35% over the next 24 years by establishing a Bitcoin reserve, provided the cryptocurrency achieves a substantial value increase by 2049.

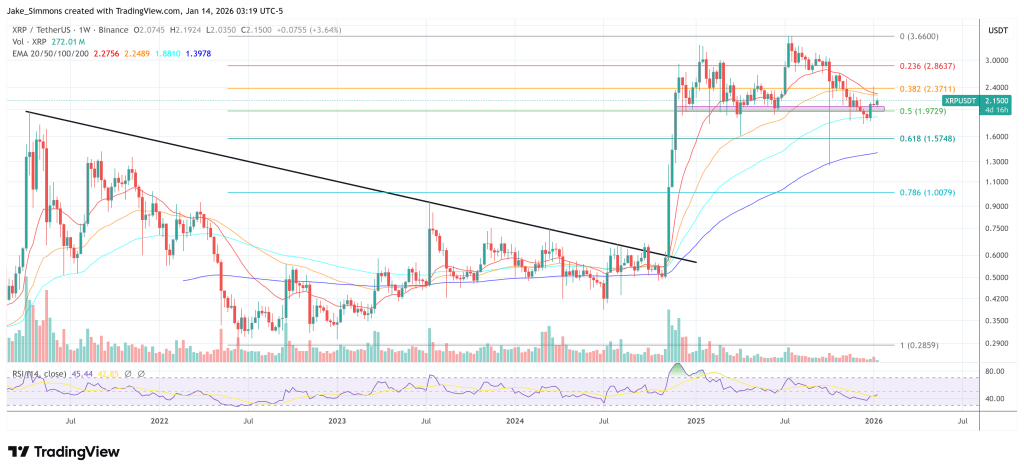

According to VanEck, if Bitcoin grows at a compounded annual growth rate (CAGR) of 25%, its value could rise to $42.3 million per coin by 2049. This growth trajectory assumes Bitcoin’s price will start at $200,000 in 2025, significantly higher than its current value of approximately $95,360.

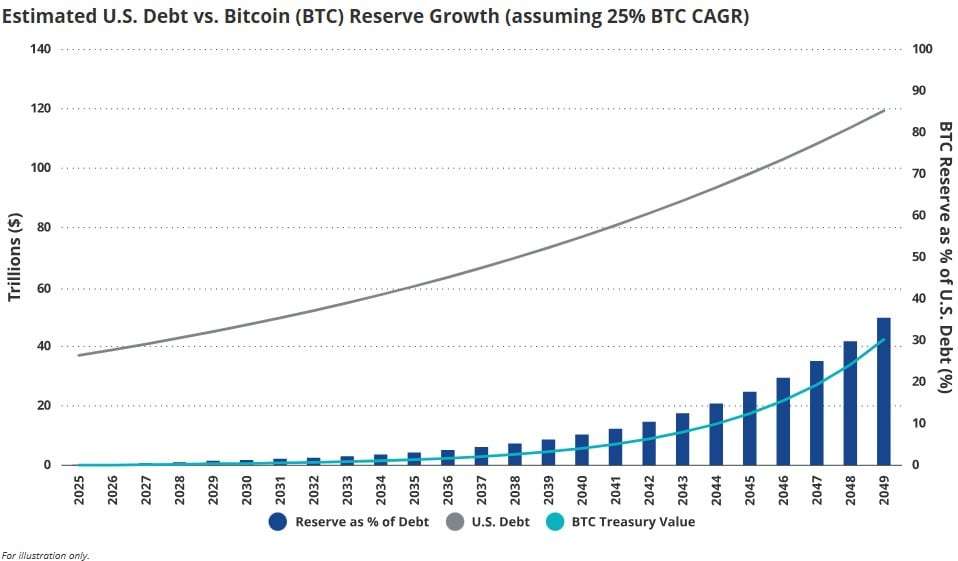

National Debt Projections vs. Bitcoin Growth

VanEck estimates the U.S. national debt is expected to grow at a CAGR of 5%, reaching $119.3 trillion by 2049, compared to $37 trillion in 2025. “The reserve could represent an estimated 35% of the national debt by 2049, offsetting ~$42 trillion of liabilities,” VanEck’s head of digital asset research, Matthew Sigel, and investment analyst Nathan Frankovitz said in a report.

Bitcoin’s potential price increase would also result in the cryptocurrency comprising about 18% of global financial assets by 2049, a sharp rise from its current share of around 0.22% in the $900 trillion market.

Policy and Implementation

The establishment of a Bitcoin reserve aligns with a bill proposed by Senator Cynthia Lummis. The bill suggests leveraging the approximately 198,100 Bitcoin held by the U.S. government through asset seizures. To reach the target of 1 million Bitcoin, additional acquisitions could be financed through the sale of a portion of the nation’s gold reserves or other mechanisms that avoid taxpayer costs or new currency issuance.

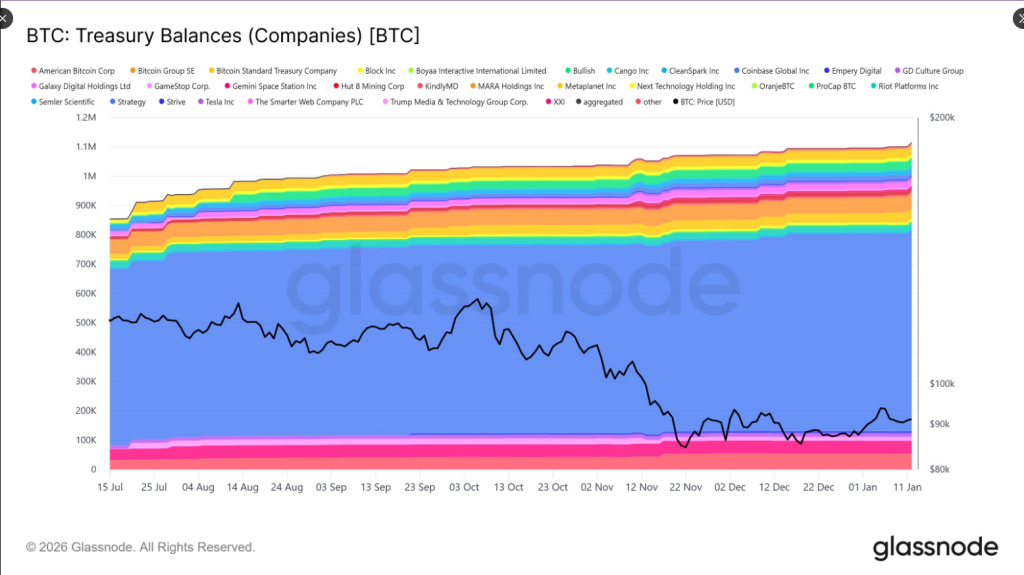

There is speculation that Bitcoin could gain further institutional and governmental adoption in the U.S., supported by favorable policies. For example, Strike CEO Jack Mallers recently hinted at a possible executive order from the incoming administration to classify Bitcoin as a reserve asset.

Global Implications

VanEck also highlights the potential for Bitcoin to become a global settlement currency, especially among countries seeking alternatives to traditional systems influenced by the U.S. dollar. As members of the BRICS bloc explore alternative trade mechanisms, Bitcoin could see expanded use in international trade.

The report underscores the transformative potential of Bitcoin adoption at state and institutional levels, suggesting its growth could significantly influence both U.S. fiscal policy and global financial systems.