Is the Altcoin Season Over? Analysts Debate the Future of Non-Bitcoin Cryptocurrencies

The cryptocurrency market is once again embroiled in a heated debate: is the era of the altcoin season—a period when alternative cryptocurrencies outperform Bitcoin—over for good? While altcoin seasons have historically been characterized by explosive price rallies for non-Bitcoin cryptocurrencies, some analysts now argue that the sheer number of altcoins and changing market dynamics have made such sustained rallies increasingly unlikely.

Historical Context: The Golden Era of Altcoins

The most notable altcoin season occurred during the 2017-2018 cycle, when coins like Ethereum (ETH), XRP (XRP), and Litecoin (LTC) achieved record-breaking gains. This period saw unprecedented growth in the altcoin market as investors flocked to promising projects that aimed to disrupt traditional industries.

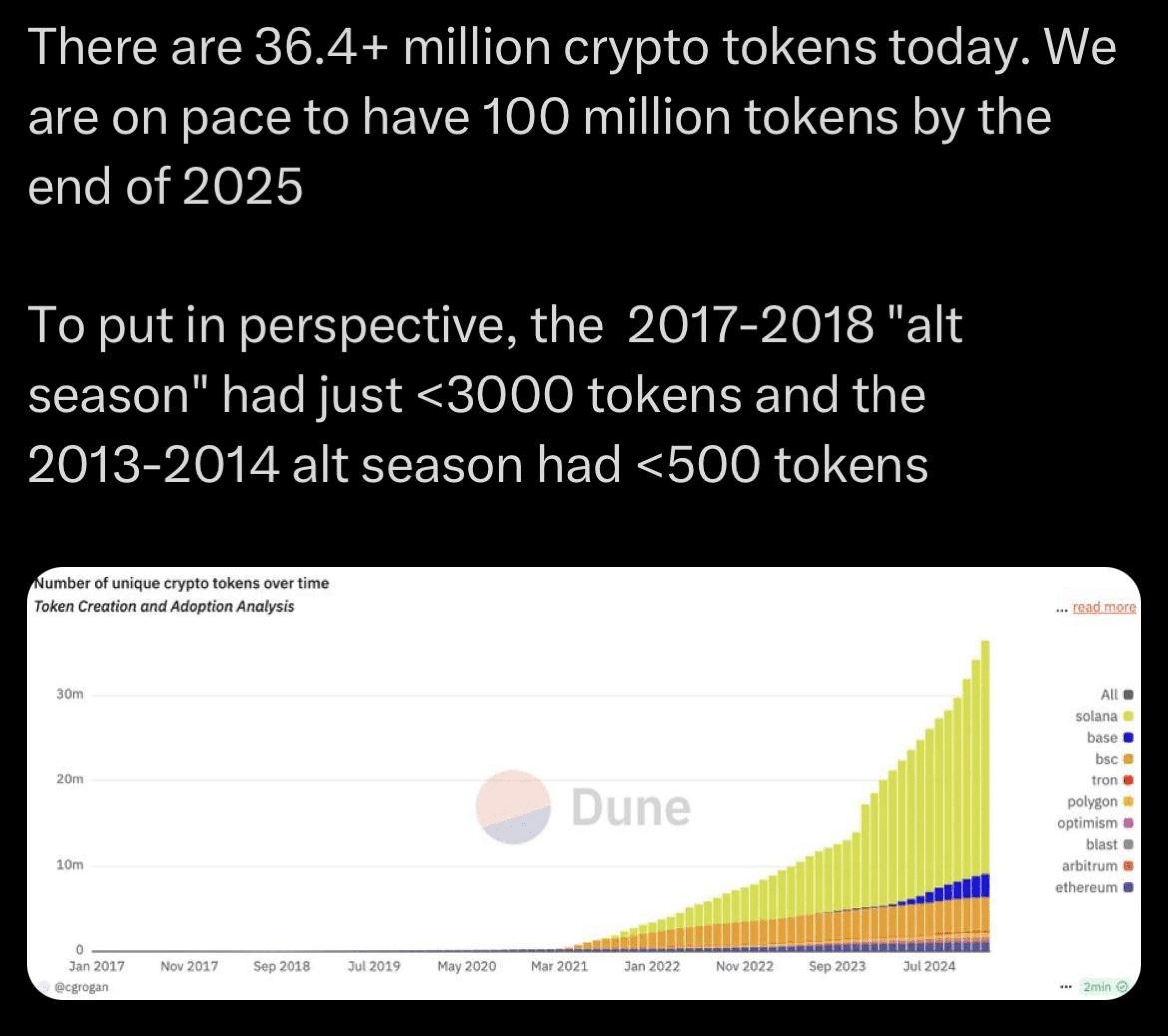

However, the altcoin market has since expanded dramatically. According to crypto analyst Ali Martinez, the number of altcoins has ballooned to over 36.4 million, compared to fewer than 3,000 during the 2017-2018 cycle and fewer than 500 during the 2013-2014 cycle. “With such massive supply, the market has changed significantly,” Martinez said in a post on X, citing data from Dune Analytics.

Oversupply and Market Saturation

The sheer number of tokens is one of the primary factors contributing to skepticism about a future altcoin season. Economist Alex Krüger highlighted this issue, stating, “Too many tokens. Infinite more to come. Supply of tokens is greater than demand.” Krüger argued that expecting an extended altcoin season akin to those of the past is “misplaced,” predicting that any future alt seasons will be much shorter, lasting only “a few days to a few weeks at most.”

Krüger also noted that the abundance of options makes portfolio management increasingly difficult. “Being a good coin picker is now very hard. Just as being a good stocks picker is also very hard,” he added.

Pseudonymous crypto trader Ash Crypto echoed these concerns, pointing to the proliferation of low-quality tokens and memecoins as a key issue. “The market is diluted,” Ash Crypto said. “Exchanges are only listing memes to grab volume and grow their user base. Retail buys these memes and [is] down 80% in a week and then quit.”

Bitcoin’s Dominance and the Future of Altcoins

Bitcoin’s dominance remains a cornerstone of the cryptocurrency market. Since 2021, Bitcoin’s market cap has doubled to $2.07 trillion, whereas the total altcoin market capitalization stands at $1.6 trillion, about 15.8% below its all-time high of $1.9 trillion reached in December 2024.

Analysts emphasized Bitcoin’s resilience and suggested that only a few altcoin projects with strong use cases and compelling narratives will survive.

Institutional Interest: A Beacon of Hope?

Not all analysts are bearish on altcoins. Michaël van de Poppe believes that utility-focused coins could still attract institutional interest. “I think that we’ll also see real utility coins take the spotlight as institutional interest continues to grow,” he said.

Van de Poppe also suggested that Ethereum could lead the next altcoin rally, calling it “the most hated rally of 2025.” As the second-largest cryptocurrency by market capitalization, Ethereum’s strong utility and adoption could serve as a catalyst for a broader altcoin resurgence.

The Road Ahead

While the future of altcoins remains uncertain, one thing is clear: the market has evolved significantly since its early days. Oversupply, market saturation, and changing investor behavior have made prolonged altcoin seasons less likely, but targeted opportunities for growth remain in utility-focused projects. For investors, the key will be discerning which projects have the potential to thrive in an increasingly competitive landscape.