Prominent figures in the digital assets industry are divided on XRP’s future amid the multiple developments within its ecosystem.

The industry has witnessed the SEC’s back-to-back acknowledgment of Grayscale Investments and 21Shares filings for the XRP exchange-traded funds. Crypto exchange Bitrue echoes the bullish outlook, citing the unfolding regulatory developments are positively shaping the XRP landscape.

Market analysts’ bold outlook for the third-largest crypto by market value is centered on the XRP ETFs update, the conclusion of the Ripple Labs lawsuit, and strategic partnership with global financial players.

Several industry experts hold contrasting views of Bitrue’s bold outlook of ongoing developments triggering a parabolic run for XRP. Weiss Crypto is among those expressing skepticism in its Friday, Feb 14 X post downplaying XRP’s future. The crypto division of financial rating firm Weiss Ratings perceives the recent regulatory developments as hardly guaranteeing an automatic boost to the XRP’s fundamental value and use cases.

XRP ETF Updates

The XRP ETF proposals are gaining traction, particularly with the US Securities and Exchange Commission (SEC) acknowledging the filings. As this unfolds, crypto analysts speculate that the approval of XRP ETFs will elevate the broader acceptance of this token as an investable asset within the institutional markets. The analysts project this to trigger upward movement for this token’s price.

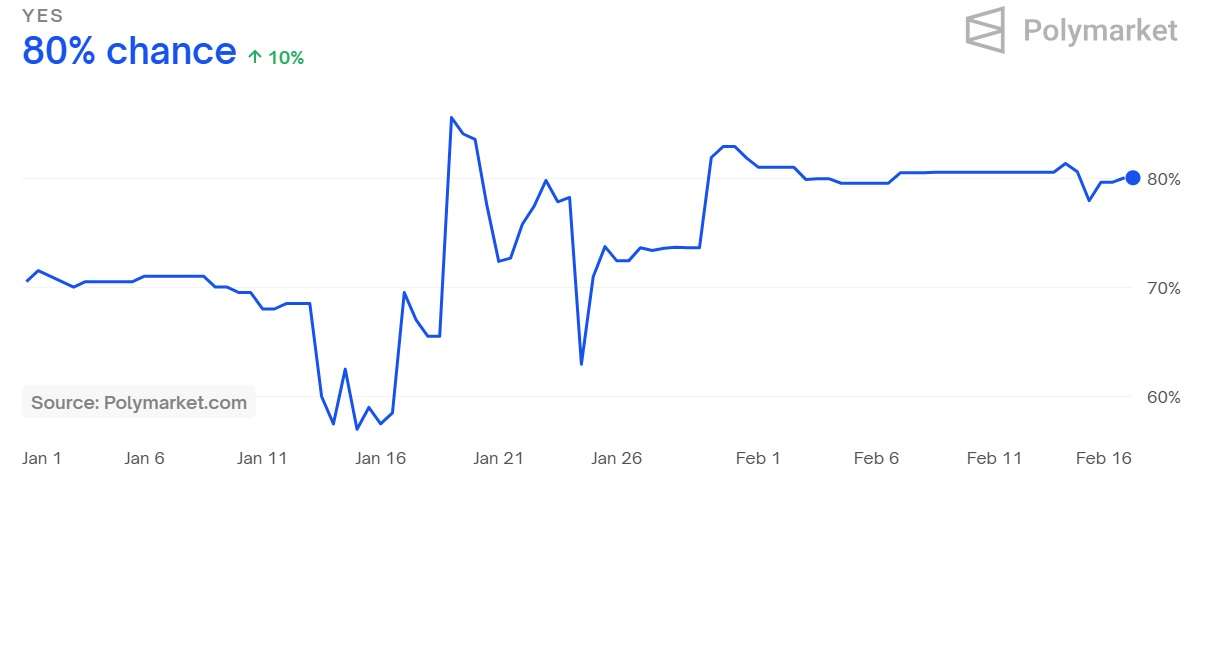

Analysts single out the likelihood of the SEC approving the XRP ETF this year, which is up 80% per Polymarket data, thus making it a critical turning point for the digital assets space. During the Gary Gensler tenure, the SEC adopted a cautious stance on crypto-based financial products, classifying XRP as security. This position ushered in a spell of strict regulatory scrutiny and multi-year legal disputes.

Before Gensler’s exit, the SEC hinted they would not approve the crypto ETFs until the new administration in 2025. With Donald Trump back in the White House and championing digital assets, the SEC appears to reconsider its approach decisively.

Weiss Crypto joins industry experts unconvinced by this optimism, highlighting that XRP suffers from limited utility. This is a persistent shortcoming that has been evident since its debut, and regulatory approval alone of ETFs could struggle to address it to trigger fuel long-term adoption.

XRP Relevance?

Messari founder Ryan Selkis questions XRP’s path to regain relevance, citing the stablecoins’ dominance in the digital assets market. The blockchain analytics expert considers that XRP would struggle to shake off the established dominance of dollar-backed stablecoins.

Selkis acknowledges stablecoins’ victory and that the upcoming US legislation will cement their position. He adds that though the pro-crypto approach by the President Donald Trump administration is monumental, stablecoin has a head start. He observes that the stablecoin market realized exponential growth while XRP encountered prolonged legal battles with the SEC, thus disadvantages.

Utility in Crypto’s Future

Although the possibility of the SEC approving XRP ETF generates industry-wide excitement, experts reiterate that XRP’s capability to have distinct and valuable use will influence its success. XRP could struggle to attain the desired success as competition intensifies from other blockchain solutions. Amid this debate, Galaxy Digital chief Mike Novogratz emphasizes the crucial input of utility to ascertain the cryptos that will thrive. The veteran crypto executive observes that the market sentiment influences the asset’s success.

Novogratz indicates that cryptocurrency’s long-term survival depends on its practical use cases. The remarks resonate with the Weiss Crypto views that as digital assets flood the space, projects lacking real-world applications could struggle to attain relevance.

Trading Volume Concerns

Ascertaining the actual test for the XRP price pump is challenging amid wishful thinking by the XRP army. This development prompted software expert Vincent Van Code to highlight skepticism on XRP trading volume relative to Bitcoin.

The software engineer opined that unless XRP attains a substantial increase in trading volume relative to Bitcoin. He decries that the XRP price lacks organic demand-driven growth and appears predominantly influenced by algorithmic trading, wash trading, and market makers.

The argument by Code attracted support from Craig Holland, who added that XRP should decouple itself from the rest of the crypto market to set an autonomous price discovery path.

A thorough analysis of the market structure, price, and liquidity of XRP shows that it has yet to break from its pioneer asset. The trading volume data on Feb 16 shows Bitcoin leading with $13.588 billion to top Ethereum’s $8.725 billion as XRP trails at $3.130 billion per CoinGecko data. The disparity between BTC and XRP bolsters Code’s argument that this altcoin trading activity has yet to indicate the breakout scenario.

Market Manipulation Concerns

Trading volume is a critical indicator of investor interest and activity. A surge in trading volume portrays stronger price movements fueled by genuine market demand. Stagnant and low volume relative to the leading assets suggests price manipulation and the absence of organic adoption.

Van Code entertains the argument that the price movement by XRP is one dictated by arbitrageurs, market makers, and high-frequency trading (HFT) bots. Unlike the organic demand by retail and institutional investors, Market makers guarantee liquidity by continually purchasing and selling XRP within a specific spread. The HFT bots execute trades rapidly to profit from the minute price inefficiencies.

Per Van Code’s account, generating the bulk of XRP trading volume using these mechanisms erodes the natural buying and selling process. This subjects the price to artificial constraints.

The industry experts question the wash trading ties in XRP to create the illusion of increased activity. Some trading platforms face allegations of inflating the market activity to attract users. The existence of such inflation in the XRP volume leads to the conclusion that its price lacks genuine supply and demand dynamics.

Why This Matters

The comment by the industry experts underscores the need for XRP to break away from the altcoin pack and chart its own merits. While the recent acknowledgment of XRP ETF filings is positive, this altcoin must establish price action relative to utility, market interest, and adoption.

Until XRP severs ties with the broader market movements and speculative trading, it will face endless debate over algorithmic, wash trading, and market manipulation influences. XRP should break free from the above forces as any perceived rally could attract critical analysis to ascertain whether it is synthetic or fueled by actual market forces.