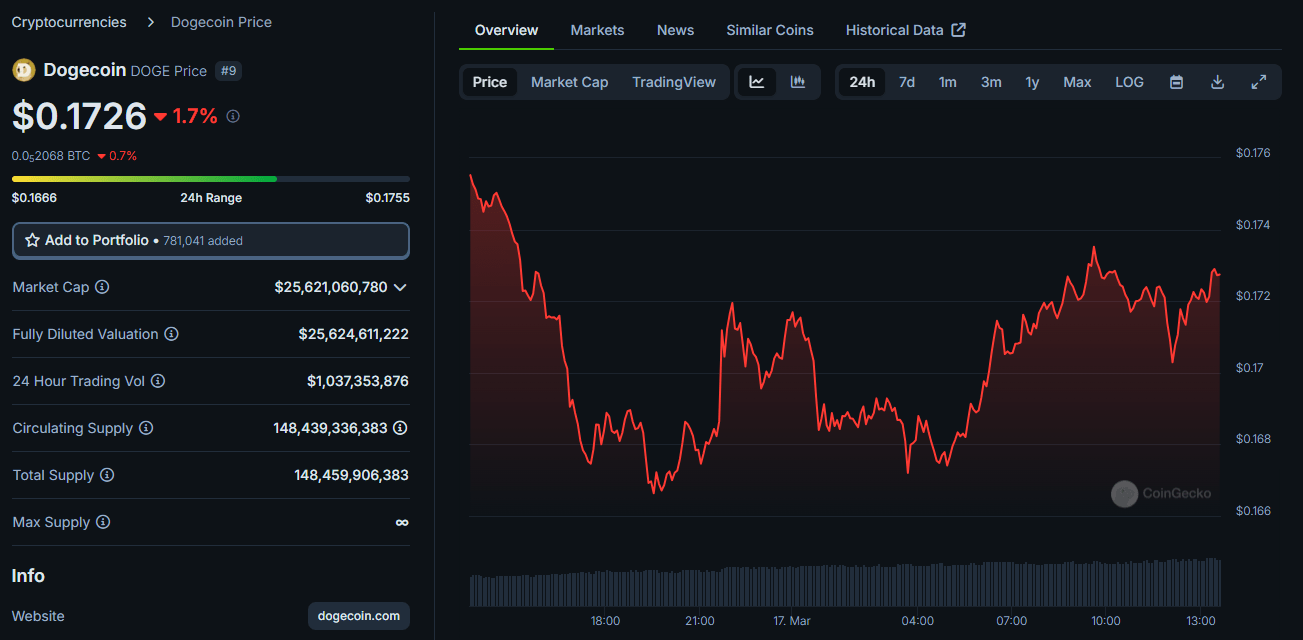

Dogecoin Price Outlook: Can DOGE Hold $0.1726, or Is More Downside Coming?

Dogecoin (DOGE), the leading meme cryptocurrency, is facing intense bearish pressure as its price hovers around the critical $0.1726 support level. After shedding nearly 30% of its value over the past week, DOGE is struggling to find solid ground amid broader market weakness and massive whale sell-offs.

Dogecoin Breaks Down From Falling Wedge Pattern

The recent drop in Dogecoin’s price follows a breakdown from a falling wedge pattern, a move that has triggered a 12% decline and formed a bearish engulfing candle on the daily chart. Typically, a falling wedge is considered a bullish reversal pattern, but the breakdown below it signals renewed control by sellers.

DOGE’s price is testing key Fibonacci retracement support at $0.1726, which coincides with the 38.2% retracement level. Losing this support could open the door for even deeper losses.

Whale Activity Adds to Bearish Momentum

The bearish sentiment is being reinforced by significant on-chain activity. According to Whale Alert, approximately 360 million DOGE (worth $62.66 million) was moved to Binance, indicating that large holders are exiting their positions. Such massive transactions typically amplify sell pressure and suppress any immediate bullish momentum.

Adding to the bearish outlook, the total meme coin market cap has fallen to $47.53 billion, down 7.71%, signaling an overall risk-off sentiment in the meme coin sector.

Technical Indicators Remain Weak

From a technical standpoint, momentum indicators are flashing red. The Relative Strength Index (RSI) has dipped toward oversold territory, suggesting a possibility of a short-term relief bounce. However, MACD and signal lines remain in a bearish crossover, indicating ongoing downside pressure.

The price has also been rejected at key trendline resistance — now retested as resistance after breaking down — further cementing the bearish bias.

Moreover, trading volumes have been in decline, highlighting that buyers are hesitant to step in, likely waiting for clearer confirmation of a reversal or stronger support zone.

Critical Price Levels to Watch

Immediate Support: $0.16

Crypto analyst Ali Martinez points to $0.16 as a crucial line in the sand. If DOGE can hold this level, it may prevent further declines and even set the stage for a potential rebound toward higher Fibonacci levels.

Potential Recovery: $0.20 to $2.00

For DOGE bulls to regain control, the price must reclaim $0.20, the 50% Fibonacci retracement, a level that also serves as a psychological barrier. A successful breach of this level could pave the way for a longer-term move back toward $2.00.

Further Downside: $0.1315

If Dogecoin fails to maintain support above $0.16, bears may drag the price down to $0.1315, corresponding to the 23.6% Fibonacci retracement. A breakdown below this level would extend the bearish trend and could invalidate any near-term bullish scenarios.

Final Thoughts: Where Is DOGE Heading?

Dogecoin’s price is currently in a vulnerable position, navigating key technical and psychological levels. With whale dumping, weak technical indicators, and declining market interest, DOGE could face further downside if $0.1726 fail to hold.

However, the oversold RSI hints at the possibility of a short-lived bounce — but for that to translate into a meaningful recovery, Dogecoin must reclaim higher levels like $0.20 to shift market sentiment.

Until then, caution is advised for traders and investors as Dogecoin continues to weather a volatile and uncertain period.