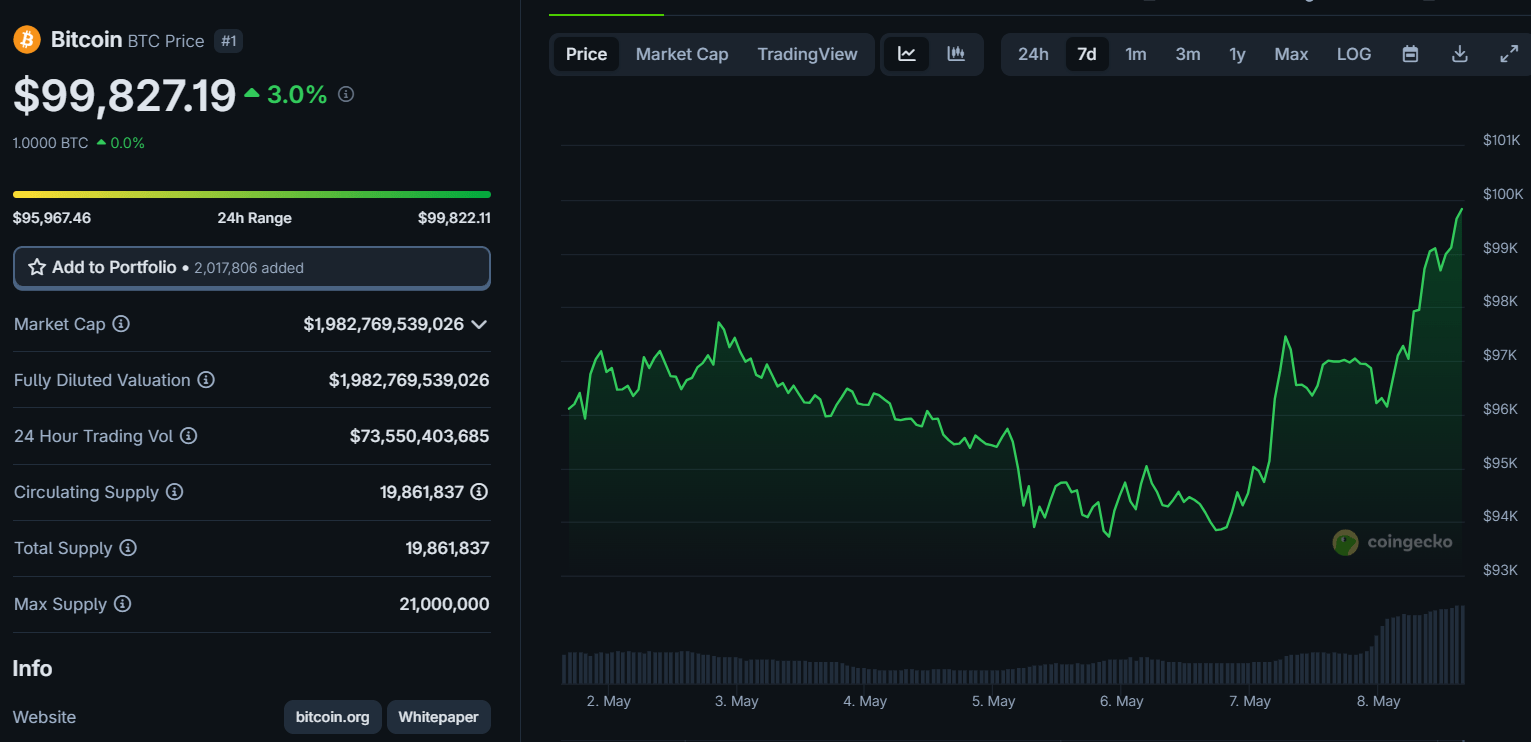

Bitcoin Reclaims $99K as Fed Pauses Rate Hikes Amid Economic Concerns

Markets respond swiftly as Jerome Powell holds firm on interest rates; Bitcoin rebounds despite inflation warnings.

Bitcoin surged past the $99,000 mark for the first time in nearly three months, reacting to the U.S. Federal Reserve’s decision to maintain current interest rates. The move, announced by Fed Chair Jerome Powell on May 7, follows weeks of market speculation and political pressure, including strong criticism from former President Donald Trump.

Fed Holds Rates Amid Economic Crosswinds

The Federal Open Market Committee (FOMC) chose to keep rates in the 4.25% to 4.50% range, citing a delicate balance between rising inflation risks and a softening labor market.

“Inflation has come down a great deal but remains above our 2% target,” Powell stated. He also pointed to declining consumer and business sentiment, largely driven by uncertainty surrounding trade policies. Despite this, Powell reassured that “the economy is still in a solid position,” with unemployment remaining low and the labor market near full employment.

Market watchers had priced in minimal chances of a rate cut prior to the announcement. According to CME Group’s FedWatch Tool, investors expect rates to drop to around 3.6% by year-end 2025.

Bitcoin Reacts: Sharp Dip, Swift Recovery

Following the Fed’s announcement, Bitcoin experienced a brief dip, falling to a low of $95,866. However, it rebounded quickly, reclaiming $98,000 — a level not seen since February 21.

The broader crypto market showed resilience, bolstered by continued institutional interest. Spot Bitcoin ETFs have seen consistent inflows, totaling approximately $4.41 billion since late March. Meanwhile, the Crypto Fear & Greed Index returned to “Greed” territory, indicating strong bullish sentiment.

Economic Outlook and Crypto Forecasts

Not all analysts are optimistic. Network economist Timothy Peterson cautioned that delayed rate cuts in 2025 could lead to broader market instability, potentially dragging Bitcoin back toward $70,000. His warning follows Powell’s March statement that the Fed is in no rush to ease monetary policy: “We do not need to be in a hurry and are well-positioned to wait for greater clarity.”

Looking Ahead

As macroeconomic uncertainties persist, Bitcoin’s price appears increasingly sensitive to signals from the Fed and broader market sentiment. With interest rates holding steady for now, all eyes will be on inflation data and future Fed commentary to gauge the next moves — both for the economy and the crypto markets.