Bitcoin Blasts Past $110K: Is $112K the Next Stop in Crypto’s Bull Run?

Bitcoin has once again rewritten the history books. Late on May 21, the world’s largest cryptocurrency surged past the $110,000 milestone for the first time, setting a new all-time high of $110,788.98 on Coinbase just before 11:30 PM UTC. As of the latest update, Bitcoin (BTC) is trading at $111,327, and momentum suggests the ride isn’t over yet.

A 3% Daily Rally, 17.5% Yearly Gains

The latest breakout has Bitcoin up 3% in the last 24 hours and 47% since its April 7 low of $75,000. That drop had rattled markets following a wave of economic uncertainty caused by sweeping tariffs introduced by former U.S. President Donald Trump. But Bitcoin’s resilience has shone through in spectacular fashion, gaining 17.5% year-to-date and reclaiming dominance across global markets.

Traditional Markets Stumble, Bitcoin Surges

Bitcoin’s surge comes amid turbulence in traditional markets. A disappointing 20-year U.S. bond auction sent treasury yields climbing and the S&P 500 dropped 80 points in just 30 minutes, triggering red across the Nasdaq and Dow as well.

With investor confidence shaken, capital is flowing into risk-on assets—particularly Bitcoin, which is increasingly seen not just as a hedge, but as a robust digital asset class on par with gold and sovereign debt.

Institutional Confidence, Not Retail Hype

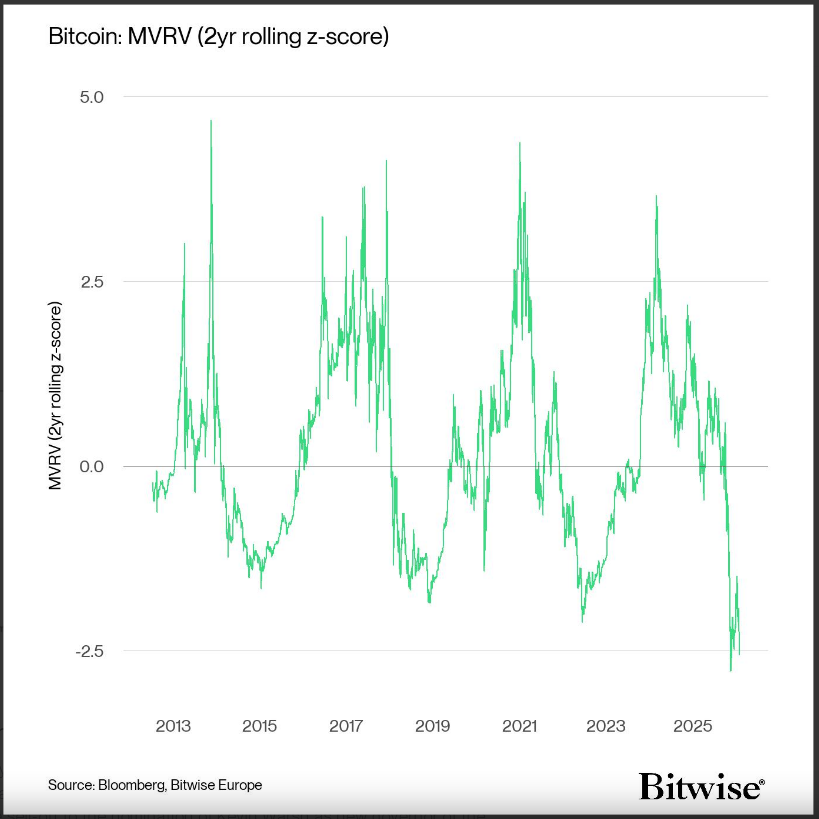

Unlike previous rallies that were largely driven by retail FOMO, today’s momentum reflects a growing institutional belief in Bitcoin’s role in the future of finance.

This rally isn’t about hype, it’s about infrastructure. Custody is better. Regulation is clearer. Institutions are allocating like never before.

Supporting that, Google Trends shows retail interest in Bitcoin remains muted—search interest has remained at levels more typical of a bear market. And yet, the price continues to soar, underscoring the increasing role of high-net-worth and institutional investors.

Market Sentiment: Greed, But Not Euphoria

According to the Crypto Fear & Greed Index, market sentiment sits at 72/100, firmly in “Greed” territory—but still below January’s peak of 84. This suggests the market has room to grow before it enters the kind of euphoric, bubble-like sentiment seen in previous cycles.

Big Bets on Bitcoin: $1.1 Billion Leveraged Long

In a dramatic showcase of conviction, trader James Wynn now holds the largest on-chain margin trade in Bitcoin’s history. His $1.1 billion leveraged long position (at 40x) has an entry price of $108,065, with an unrealized profit of over $20 million. His position will be liquidated if Bitcoin dips below $103,800—a bet as bold as the current market.

What’s Next? $112K and Beyond

With the psychological barrier of $110,000 broken and momentum building, many analysts believe $112,000 is within reach—possibly within days.

But where does Bitcoin go from there?

Some market analysts are already calling for $160,000 by Q4 2025, and long-term forecasts—bolstered by growing institutional inflows and supply constraints—put $1 million per BTC by 2030 within the realm of possibility.

As macroeconomic uncertainty continues, and the narrative of “digital gold” gains traction, Bitcoin’s role as a decentralized, limited-supply store of value is only becoming more appealing.

Final Thoughts

Bitcoin has now entered uncharted territory. While volatility is to be expected, the broader picture suggests this is not just another speculative cycle. With solid fundamentals, institutional backing, and weakening confidence in fiat markets, the world’s first cryptocurrency may just be getting started.

The next stop? $112,000—and beyond.