Bitcoin ETFs have had substantial withdrawals totaling $1.3 billion over the last two weeks. Analysts are nevertheless optimistic about a market rebound in the upcoming months in spite of this.

Overview of Outflows

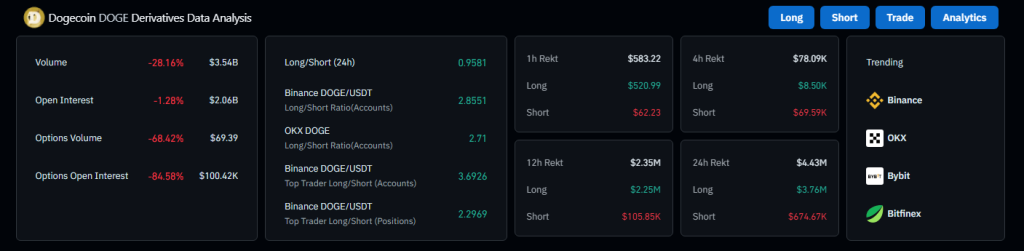

United States spot Bitcoin exchange-traded funds (ETFs) have witnessed a substantial $1.3 billion outflow in the last fortnight. This decrease comes with the ongoing downward trend in the price of Bitcoin. According to data from Farside Investors, withdrawals from Bitcoin ETFs totalled $1.298 billion, with Grayscale recording the largest outflows at $517.3 million over this time frame.

Bitcoin’s Price Performance: A Glimmer of Hope

Interestingly, the only fund that has performed well is BlackRock’s Bitcoin ETF, which has drawn $43.1 million in inflows during the same period of time. This stands in sharp contrast to the general trend of withdrawals that other Bitcoin ETFs are seeing.

As of this writing, the price of bitcoin has dropped by 11.6%, from $69,476 on June 10 to $61,359 at this time. The net outflows from Bitcoin ETFs between April 24 and early May exceeded $1.2 billion, making this wave of withdrawals the worst since April.

Market Insights

Chief Investment Officer of digital asset trading company ZeroCap, Jonathan de Wet, offered his market observations. He pointed out that even if the entire cryptocurrency market is still struggling, Bitcoin may reach its “key support” level of about $57,000 in the upcoming weeks, especially since Mt. Gox creditor obligations are about to come due.

In his remarks, de Wet noted that “BTC and ETH are holding up surprisingly well compared to the rest of the market, with key support at $63,000 and $3,400, respectively,” stressing that they are still within the current range of prices.

Concerns and Predictions

Numerous industry watchers have voiced their worries regarding possible downside pressure for Bitcoin. The German government’s sale of Bitcoin and the $9 billion in projected BTC repayments to Mt. Gox creditors—which are predicted to be released into the market in July—may be the sources of this pressure.

De Wet keeps a hopeful long-term outlook in spite of these worries. Though he is still upbeat about the future, he expects more drops as a result of selling pressure from Mt. Gox creditor obligations. “Medium to long-term, we are constructive, given the ETH ETF launch and the expected easing bias towards the end of 2024, with actual easing in 2025,” he said.

A Different Perspective

All analysts do not share concerns over the implications of Mt. Gox creditor repayments. According to eToro market analyst Farhan Badami, major market events frequently determine Bitcoin values in advance. In the upcoming weeks, he anticipates that the price of Bitcoin will stabilize, and in the following few months, he forecasts a surge to all-time highs. “Within the next few weeks, it’s possible we will be range-bound between $60-70K USD,” said Badami.

Conclusion

Despite significant outflows from Bitcoin ETFs in recent times, analysts continue to be cautiously optimistic. Although there might be short-term difficulties in the market, many analysts think that Bitcoin will stabilize and possibly even soar to new heights in the upcoming months. As the cryptocurrency industry develops further, check back for additional information.