A Shaky Start for Bitcoin in February: Trade War Concerns Rock Crypto Markets

February began with a significant downturn for Bitcoin and the broader crypto market as fears of a new U.S.-led trade war rattled investors. The digital asset world—often viewed as a barometer for market sentiment—was not immune to the widespread panic that spread across risk assets.

Bitcoin Plummets Amid Market Turmoil

Bitcoin (BTC) saw its value drop by nearly $6,000 from its weekly close, hitting lows not seen since mid-January. The leading cryptocurrency hovered near the $90,000 mark after an intense wave of selling pressure swept through the market. This sell-off led to over $2 billion in liquidations across various crypto assets within a 24‑hour period, according to data from CoinGlass.

Market analysts have pointed out that order book liquidity and a desire to “fill the wick” formed by previous lows contributed to the bearish momentum. Trader CrypNuevo highlighted $94,700 as a key liquidation level, predicting further downside risk. For more detailed insights into these price movements, check out our in‑depth Bitcoin Price Analysis.

Altcoin Capitulation and Bitcoin Dominance

The turmoil wasn’t limited to Bitcoin. Altcoins experienced sharp declines, with many tokens shedding over 20% of their value within a day. This prompted what traders are calling “capitulation wicks,” where desperate selling at extreme prices becomes evident.

Meanwhile, Bitcoin’s dominance over the total crypto market capitalization briefly spiked to 64.3%—its highest level in nearly four years—highlighting investors’ shift toward perceived stability. To better understand how market capitalization impacts investor sentiment, explore our guide on Market Capitalization of Cryptocurrencies.

The Trade War’s Ripple Effect

The sudden market crash coincided with the U.S. government’s decision to impose 25% tariffs on trade with Canada and Mexico. President Donald Trump defended the move, acknowledging the potential for short‑term economic pain while emphasizing long‑term benefits.

“We may have short‑term pain, but long‑term gains will make this worthwhile,” Trump stated in a press briefing. The announcement sent shockwaves through traditional financial markets, with the S&P 500 losing $1 trillion in value following the futures open.

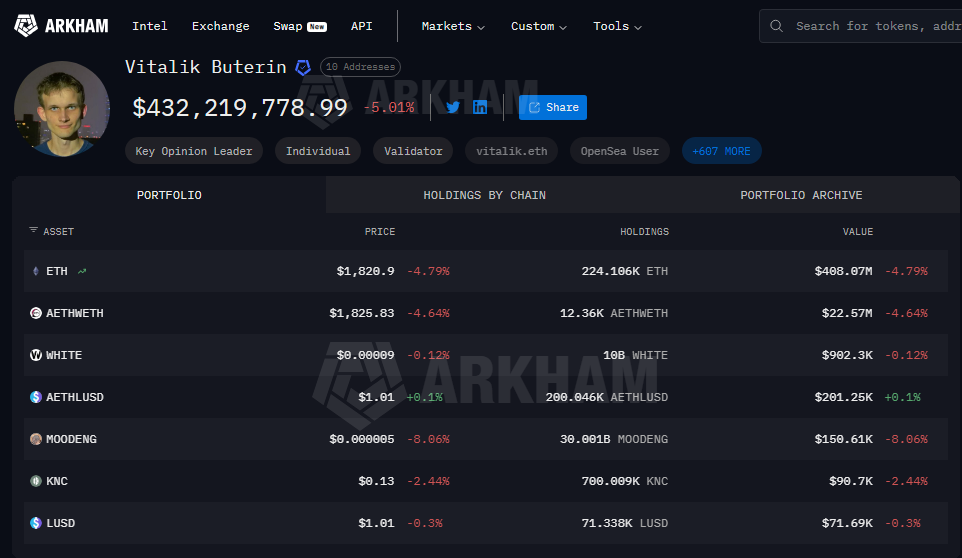

Crypto markets felt the brunt of the panic, with Ethereum (ETH) dropping 37% in just 60 hours. The total crypto market capitalization fell by over $760 billion, marking a dramatic 21% decline in three days.

Federal Reserve and Macro Fallout

The trade war developments come as the Federal Reserve faces mounting pressure to cut interest rates. Fed Chair Jerome Powell recently hinted that rate adjustments could be made without waiting for inflation to meet the 2% target.

Former BitMEX CEO Arthur Hayes weighed in on the situation, predicting that a liquidity injection from the Fed might be inevitable.

“The beatings shall continue until morale improves. When TradFi outfits near bankruptcy, the Fed will have no choice but to print money.” – Arthur Hayes

Testing Key Bitcoin Support Levels

Despite the chaos, Bitcoin speculators are closely watching key support levels. The cost basis for short‑term holders (STHs) currently sits just below $92,000—a crucial level for maintaining bullish momentum. Glassnode, a leading on‑chain analytics platform, emphasized the importance of this metric: “If Bitcoin price flips the STH cost basis to resistance, it could signal waning sentiment among new investors.”

Sentiment Dips as Fear Grips the Market

Investor sentiment has taken a hit, with the Crypto Fear & Greed Index dropping 32 points in just three days to its lowest level since October. Traditional market sentiment has similarly declined, with stocks also reflecting a mood of “fear.” However, some market analysts see opportunity in the downturn. “Big declines in sentiment are often a good time to start adding exposure in Bitcoin,” said Andre Dragosch, European head of research at asset management firm Bitwise.

Looking Ahead

As February unfolds, crypto traders and investors are bracing for a volatile market environment. The combined pressures of macroeconomic uncertainty, Federal Reserve policy shifts, and ongoing trade war concerns are likely to shape market dynamics in the weeks to come.

To learn more about the evolving market conditions and what lies ahead, check out our Crypto Industry Outlook.

While Bitcoin’s ability to hold critical support levels offers some hope, broader market sentiment remains cautious. As always, investors are urged to conduct thorough research and stay vigilant during these unpredictable times.