Introduction to Bitcoin

Bitcoin, a groundbreaking innovation, emerged as a novel form of digital currency, introducing the concept of decentralized financial transactions. Its inception traces back to the visionary work of an entity or individual known as Satoshi Nakamoto. This revolutionary idea of decentralization, a cornerstone in the Bitcoin ethos, challenges traditional financial systems by eliminating the need for centralized control.

The Early Years (2009-2012)

In Bitcoin’s infancy, its first recorded price represented only a fraction of its future value. This period witnessed a burgeoning community of early adopters and enthusiasts, alongside the first significant security breaches, marking a tumultuous start. During these formative years, the rise of Bitcoin exchanges played a pivotal role, providing a platform for trading and valuing this nascent digital asset.

Major Milestones and Setbacks (2013-2016)

The period between 2013 and 2016 was marked by significant events that shaped Bitcoin’s trajectory. The first major spike in its value captured global attention, while the Mt. Gox scandal, involving one of the largest Bitcoin exchanges, highlighted the vulnerabilities and regulatory challenges facing the digital currency. Despite these hurdles, this era also saw the early acceptance of Bitcoin by merchants, signaling growing mainstream interest.

Bitcoin Halvings and Their Impact

Bitcoin halvings, occurring approximately every four years, are pivotal events that reduce the rate of new Bitcoin creation, influencing its scarcity and price. The 2020 halving, occurring amidst the COVID-19 pandemic, drew particular attention to Bitcoin’s resilience and role as a potential hedge against economic uncertainty.

Bitcoin’s Price Volatility

Bitcoin is notorious for its price volatility, characterized by sharp rises and sudden crashes. Various factors contribute to this, including market sentiment, regulatory news, and technological developments. Notable flash crashes, often resulting from external influences or market dynamics, offer insights into the complex interplay of factors driving Bitcoin’s price movements.

Technological Evolution and Bitcoin

The continuous evolution of blockchain technology, the underlying mechanism of Bitcoin, directly impacts its growth and adoption. Significant forks in the Bitcoin network have led to both technological advancements and debates within the community, influencing its price and future direction.

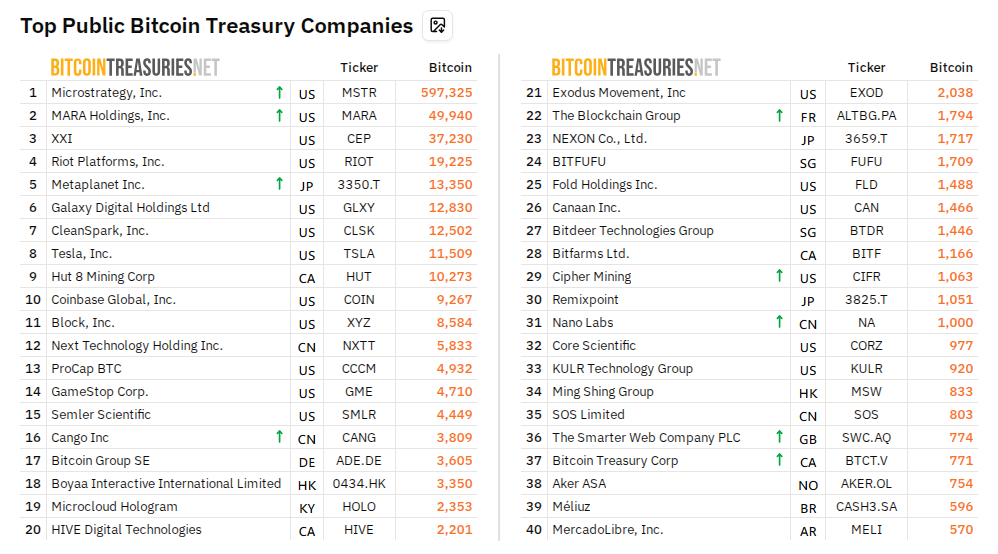

Institutional Adoption and Investment

In recent years, institutional investment in Bitcoin has surged, with major companies and notable individuals allocating significant portions of their portfolios to this digital asset. This trend not only bolsters Bitcoin’s legitimacy but also influences its market dynamics.

Bitcoin and Macro-Economic Factors

Bitcoin’s price movements often correlate with global economic events, offering an intriguing study into its role as a digital asset in the broader financial landscape. Factors such as interest rate changes and inflation rates can impact its value, reflecting its sensitivity to macroeconomic trends.

Bitcoin in the Public Eye

The public perception and media coverage of Bitcoin have evolved significantly over the years. From being a niche interest to a mainstream topic, the role of social media in shaping Bitcoin’s narrative has been profound, influencing both public opinion and market behavior.

Future Predictions and Speculations

Looking ahead, predictions for Bitcoin’s trajectory post-2024 halving vary widely, with analysts offering differing views on its future price movements. This section will delve into the latest data and expert insights on Bitcoin’s price predictions for the next ten years, from 2024 to 2030.

Analysts from Matrixport project that BTC’s value will ascend to $50,000 by January. This prediction is based on a variety of influences, including the anticipated approval of spot bitcoin ETFs, increased institutional investment, limited supply, and historical patterns.

Matrixport’s previous predictions, detailed here and here, have either materialized or nearly materialized.

Furthermore, these analysts foresee BTC reaching $63,000 in April and escalating to $125,000 by the end of 2024.

Conclusion

Reflecting on Bitcoin’s historical journey, from its obscure beginnings to its current status as a significant financial asset, offers insights into the potential future trajectory of this pioneering digital currency. The final thoughts will encapsulate Bitcoin’s past, present, and speculated future, framing its role in the evolving landscape of digital finance.