Can Bitcoin Reach $220,000 in 2025? Gold-Based Forecast Models Say It’s Possible

As Bitcoin continues to mature as a digital asset, new forecasting models are increasingly comparing its performance to that of gold. A rising number of market observers believe that Bitcoin could reach as high as $220,000 in 2025, based on historical patterns, market cycles, and its evolving relationship with gold.

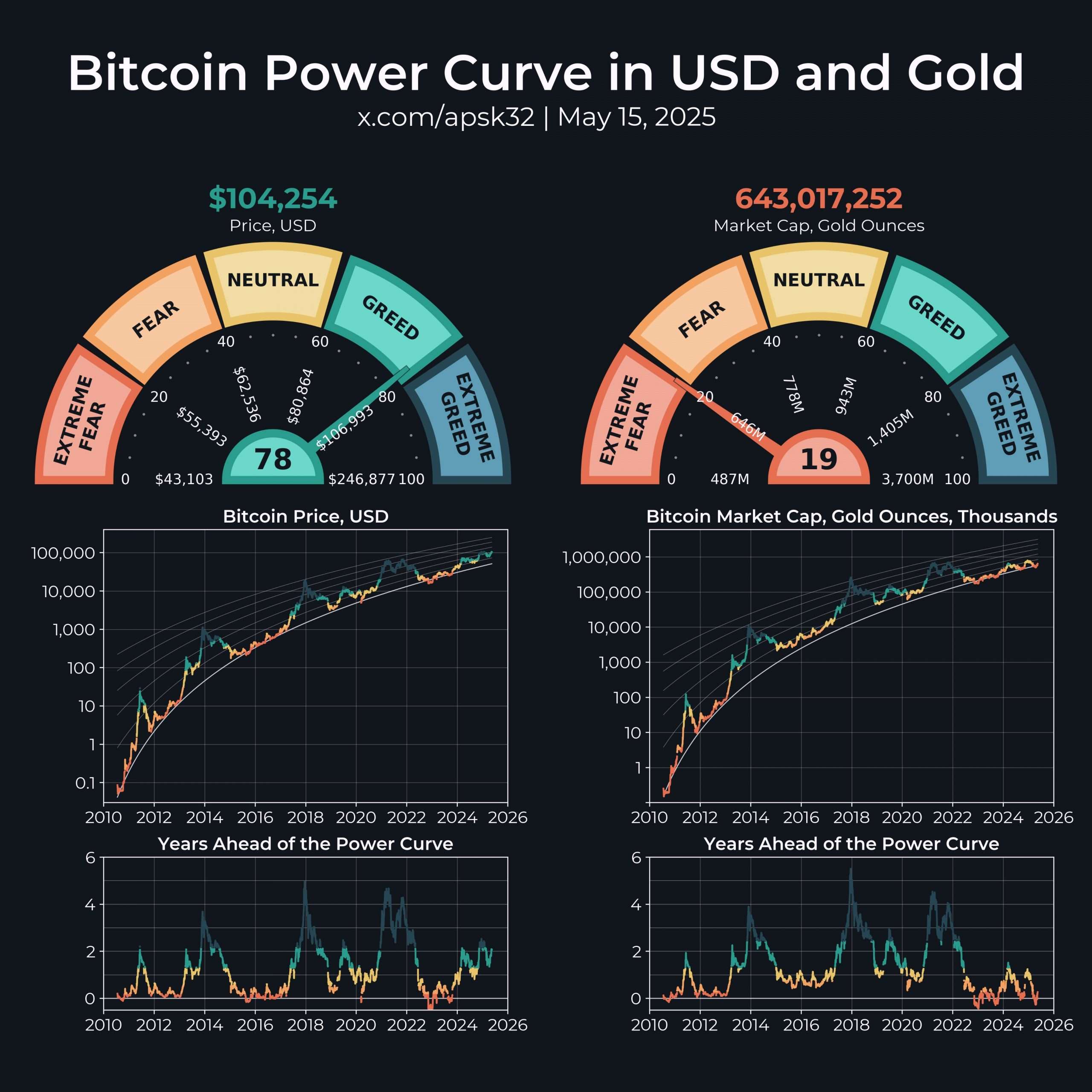

The Bitcoin “Power Curve” and Price Projections

One of the more notable forecasting tools being used today is based on a concept known as the “power curve,” which tracks Bitcoin’s market value relative to gold rather than fiat currencies. By measuring Bitcoin’s market capitalization in ounces of gold, this model aims to eliminate the influence of inflation from fiat currencies such as the U.S. dollar.

The model suggests that if Bitcoin’s valuation continues to follow a historical growth trajectory and gold maintains or increases its current value, Bitcoin could experience significant upside. Under favorable market conditions, projections indicate a potential peak price of over $200,000 in 2025, with some speculative estimates suggesting $250,000 or more as an upper bound under bullish scenarios.

This forecast relies on Bitcoin’s consistent four-year halving cycle, which has historically contributed to upward price movements following each reduction in new supply. If this pattern holds true, the next peak could surpass all previous highs.

Bitcoin and Gold: A Growing Correlation

Gold has long been seen as a hedge against inflation and market uncertainty. Bitcoin, often referred to as “digital gold,” is increasingly being viewed in a similar light due to its fixed supply, decentralized nature, and resistance to debasement.

Over the years, Bitcoin has demonstrated a tendency to follow gold’s broader price trends, though with a time lag. When gold hits new highs, Bitcoin has often trended upward shortly after, reflecting growing investor interest in non-sovereign, scarce assets.

In this context, if gold continues its upward trajectory and reaches $3,500 or even $5,000 per ounce by the end of the decade, Bitcoin may mirror that momentum and set new record highs.

A $1 Million Scenario by the Decade’s End?

Looking beyond 2025, some scenario-based models explore what could happen if Bitcoin captures a significant portion of gold’s total market capitalization. If Bitcoin were to achieve even 50% of gold’s projected market cap in a future where gold is valued at $5,000 per ounce, the price of Bitcoin could theoretically approach $1 million.

This projection is not intended as a guaranteed outcome, but rather as an illustrative scenario demonstrating Bitcoin’s potential if it continues to evolve as a mainstream store of value. The concept hinges on increased global adoption of Bitcoin as a digital alternative to gold, especially among institutional investors and sovereign entities.

Final Thoughts

While precise predictions are inherently uncertain, the idea of Bitcoin reaching $220,000 or more in 2025 is gaining traction among market forecasters who use long-term historical patterns and gold-based valuation models. These models present Bitcoin as a maturing financial asset capable of rivaling traditional hedges like gold in times of economic turbulence.

Whether Bitcoin can fulfill these ambitious price targets will depend on several variables, including macroeconomic conditions, regulatory developments, adoption trends, and continued alignment with its historical growth curves. Regardless of the exact outcome, the convergence of Bitcoin and gold narratives is reshaping how investors perceive digital assets in a shifting global economy.