Cardano Holds Firm at $0.66 Amid Market Uncertainty: Is a Bullish Reversal on the Horizon?

Summary:

- ADA remains steady at $0.66 following multiple rebounds from the $0.58–$0.62 support zone.

- Whale transaction volume in April signals strategic accumulation despite broader market downturns.

- New tech allows Bitcoin to interact with Cardano directly, hinting at a future boost in cross-chain activity.

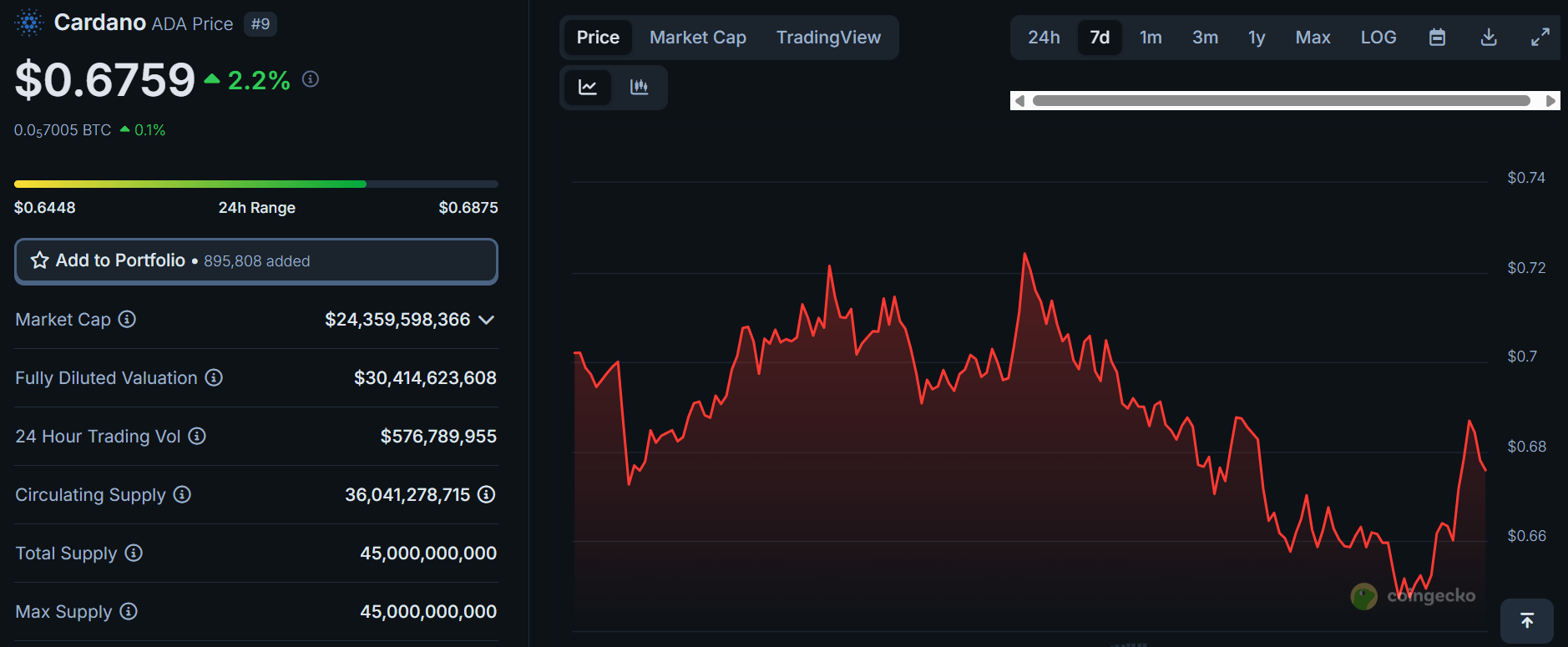

ADA Maintains Key Support After Market Pullback

Cardano (ADA) appears to be stabilizing after weathering early May’s volatility. The asset has found support around the $0.66 mark, showing resilience after dipping as low as $0.6541. Although ADA is down nearly 3% over the past 24 hours, it continues to hover above a vital price floor — a zone that has previously acted as a stronghold for buyers since March 2025.

Despite short-term bearish sentiment, ADA’s current structure shows signs of strength. The $0.58–$0.62 region has been retested several times, and each time, it has prompted accumulation activity that helped price recover. This consistent defense of support may indicate that bulls are preparing for a potential reversal.

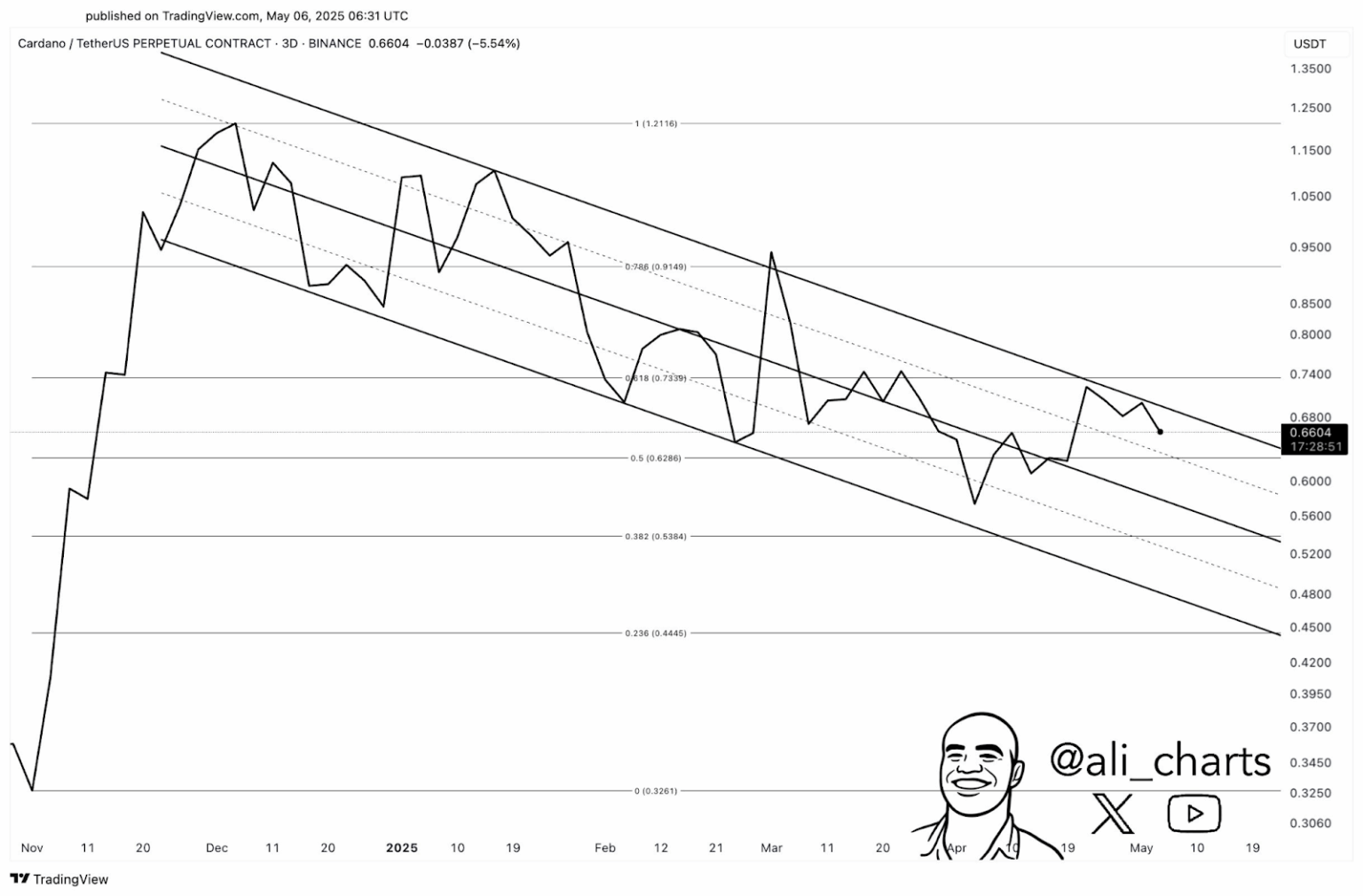

Source: X

Technical Signals Point Toward Potential Upside

Recent trading data suggests ADA is locked in a descending channel, with resistance capped below $0.70. Although the price was rejected near the top of this channel, Cardano has maintained a higher low — a potential early sign of bullish momentum building.

Indicators like the MACD and RSI are currently flat, suggesting indecision. However, hidden bullish divergence could be forming as momentum indicators trend upward while the price continues to retest recent lows. Combined with tightening Bollinger Bands, this indicates a possible breakout scenario if buying pressure continues.

Analysts are eyeing resistance levels at $0.70, $0.78, and $0.88, with a breakout above these thresholds possibly pushing ADA back toward the psychological $1.00 barrier.

Whale Transactions Signal Institutional Activity

On-chain analysis reveals an uptick in large-volume ADA transactions, particularly during April 2025. Transactions exceeding $100,000 surged in the lead-up to Cardano’s recent price highs, suggesting institutional accumulation. While April’s whale activity dipped from its December peak of $9.12 billion to $7.46 billion, the continued interest from high-value wallets points to strategic repositioning rather than mass exit.

Historical data from previous cycles shows that periods of high-value accumulation often precede major rallies. Market watchers are now looking to see if similar conditions will unfold in the weeks ahead.

Source: CoinGecko

Bridgeless Bitcoin Transfers Boost Cardano Interoperability

In a major technical breakthrough, developers have successfully enabled native Bitcoin transfers to and from the Cardano blockchain — with no bridge, third-party custodian, or centralized intermediary. This feat, achieved through BitcoinOS, marks a pivotal step in blockchain interoperability.

This approach preserves users’ control over their private keys while enabling Bitcoin to interact with decentralized applications (dApps) on Cardano. Analysts believe this innovation could spark broader developer interest and help Cardano position itself as a leading platform for secure, multi-chain applications.

Looking Ahead: Can ADA Break Out of Its Current Range?

Cardano’s price remains firmly within a descending structure, yet the recent price action near $0.66 indicates increasing buyer interest. The current Fibonacci retracement range — between 0.5 and 0.618 — is often seen as a potential reversal zone in technical analysis.

With green candle volume gradually rising and support repeatedly tested, the conditions may be forming for an upward breakout. A push beyond the $0.70 resistance level could open the door for ADA to test higher targets in the near term.

While the market remains cautious, the convergence of whale interest, new interoperability tools, and strong technical support may lay the groundwork for ADA’s next major move.