Crypto Market Heats Up as Stablecoin Supply Hits Record Levels, Analysts Predict Altcoin Rally

As April draws to a close, momentum is building across the crypto markets, with several indicators pointing toward the beginning of a bullish phase—potentially paving the way for a strong altcoin season.

Market sentiment has shifted noticeably in recent days, fueled by a massive surge in stablecoin issuance and the continued resilience of major cryptocurrencies, even amid uncertain macroeconomic conditions. A few analysts point to this convergence of bullish signals as reminiscent of the late 2023 rally, where liquidity, technical breakouts, and retail interest aligned to propel digital assets forward.

Stablecoins Signal Growing Liquidity

One of the most significant developments was recorded on April 29, when Tether minted two back-to-back $1 billion batches of USDT. These events pushed the combined supply of the two leading stablecoins, USDT and USDC, to new all-time highs. This stablecoin expansion is not just a technical rebalancing—it reflects genuine demand entering the market, especially given the observed premiums in USDT/USD trading pairs on platforms like Kraken.

Increased stablecoin liquidity is often a precursor to a rise in crypto asset prices, as it provides readily deployable capital for trading and investment across the ecosystem.

Bitcoin Holds Strong Despite Economic Pressure

Bitcoin continues to trade with strength above the key $90,000–$95,000 zone, showing remarkable resilience in the face of less-than-stellar economic data. The U.S. recently reported weak GDP growth and persistent inflation, yet Bitcoin shrugged off the noise, maintaining upward pressure. This performance stands in contrast to gold’s recent weakness and a weakening U.S. Dollar Index, further highlighting BTC’s appeal as a digital store of value.

Adding to the complexity, funding rates across markets present a split picture. While BTC futures on traditional platforms remain positive, several crypto exchanges show negative funding rates—a divergence that underscores varying trader expectations.

Altcoins Start to Flash Bullish Signals

While Bitcoin leads the charge, altcoins are beginning to carve out their own narratives. Solana is forming a classic inverted head-and-shoulders pattern, hinting at a breakout above $200. Curve Finance defied broader market conditions with a sudden double-digit rally, underscoring that selective altcoins are already gaining momentum.

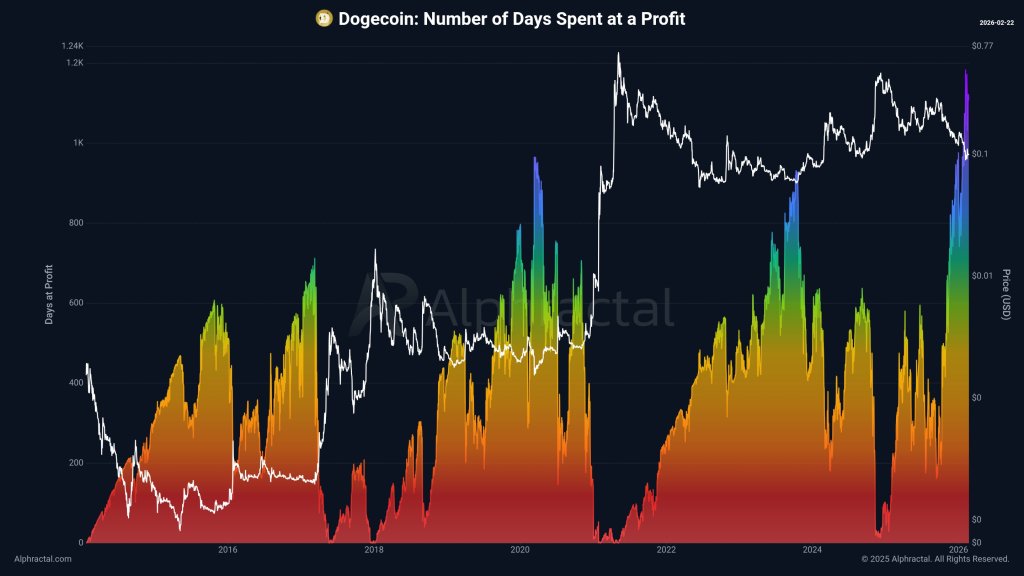

Ethereum, meanwhile, appears to be in a slow accumulation phase, possibly bottoming out through May and June. Litecoin is following a similar consolidation path. Meanwhile, meme coins like Dogecoin are showing promising technical setups, suggesting that retail traders may be returning to the market with renewed interest.

Altcoins could see substantial outperformance in the coming weeks, especially if current technical structures align with volume and follow-through. However, analysts caution against premature positioning and recommend waiting for clear signals before deploying capital.

Emerging Projects and Market Divergence

In the emerging protocol space, projects like Fetch.ai, Chainlink, and Algorand are showing different levels of technical readiness, each offering opportunities based on individual setups and cloud-based trend indicators.

Interestingly, this growth narrative is unfolding against a backdrop of funding anomalies, where traditional finance and crypto-native markets reflect diverging sentiment. These discrepancies may offer arbitrage opportunities or foreshadow changes in positioning across investor segments.

Conclusion: A Market Poised for Rotation

With record-high stablecoin reserves, strong Bitcoin support, and bullish patterns emerging across key altcoins, the conditions are increasingly favorable for a potential rotation from BTC dominance to wider altcoin gains. As always, disciplined trading and confirmation-based entries will be key in navigating what could be an explosive May–June period in the crypto space.