Decentralized Banking is Becoming Mainstream: How DeFi is becoming ‘NewFi’

Traditional institutional titans, such as BlackRock, which manages $10.6 trillion, have entered the Bitcoin industry.

As institutional interest in cryptocurrency develops, fuelled by the launch of Bitcoin and Ether exchange-traded funds (ETFs) in the United States, investors and industry participants are discussing the future of decentralized finance and its relationship to traditional finance, or TradFi.

The discussion centers on whether institutional involvement in cryptocurrency is a net benefit or bad for the space. In a recent interview with Cointelegraph, James Toledano, Chief Operating Officer of Savl, a self-custodial wallet platform, said that institutional involvement in cryptocurrency would be beneficial to its long-term growth, lending legitimacy to the emerging asset class and the underlying technology in the minds of skeptical individuals, particularly those in older generations.

Toledano addressed the elephant in the room, noting that these enormous organizations have the capacity to dominate the cryptocurrency space by controlling all or a majority of a digital asset’s supply. However, he stated that such a plan was improbable, as “if they did that, they would shoot themselves in the foot because most people wouldn’t want to own it.”

Instead, self-custodial solutions are anticipated to account for the great bulk of the market, while financial institutions will continue to cohabit with decentralized finance, interacting with distributed protocols in what Toledano referred to as “NewFi,” or “new finance.”

“I believe that if institutions owned 20% of these assets and sold them as spot ETFs or whatever, the remaining 80% would be owned by the general people. “That makes sense.”

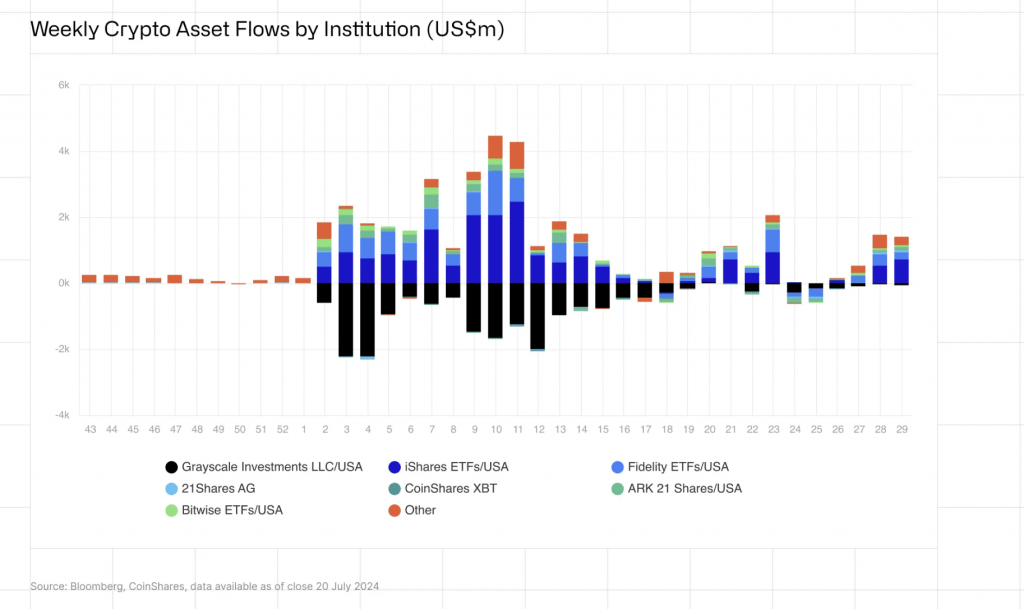

A chart showcasing weekly inflows into crypto investment funds. Source: CoinShares

Institutional investments in digital asset investment vehicles

According to the most recent CoinShares weekly inflow report, dated July 22, digital asset investment vehicles saw $1.35 billion in inflows over the seven-day period, driven mostly by investors in the US.

On July 23, spot Ether ETH $3,326 exchange-traded funds became live on US stock exchanges, with trading volume exceeding $1 billion in a single day, demonstrating the high institutional demand for crypto ETF products.