Navigating the Impact of Trump’s Tariffs on Cryptocurrency and Global Markets

The financial world is reeling following the announcement of new tariffs imposed by U.S. President Donald Trump. These measures, which officially took effect on February 4, 2025, target major trading partners, including Canada, Mexico, and China. While tariffs are a tool often used to balance trade deficits and address security concerns, they have sparked widespread economic uncertainty, triggering a sharp sell-off in both traditional financial markets and the cryptocurrency sector.

Understanding the Tariffs

Trump’s tariffs impose a 25% levy on imports from Canada and Mexico, as well as a 10% tariff on Chinese goods. The rationale? Addressing issues such as illegal immigration, drug trafficking, and reducing economic dependence on foreign supply chains. According to the President, trade deficits and concerns about foreign goods flooding the U.S. market necessitated the move.

Despite these intentions, the announcement has been met with swift resistance. Canada and Mexico quickly retaliated with plans to introduce their own tariffs, though temporary agreements have since postponed these measures by 30 days. China has indicated a willingness to negotiate, but the looming trade disputes have already left their mark on global markets.

Immediate Market Reactions

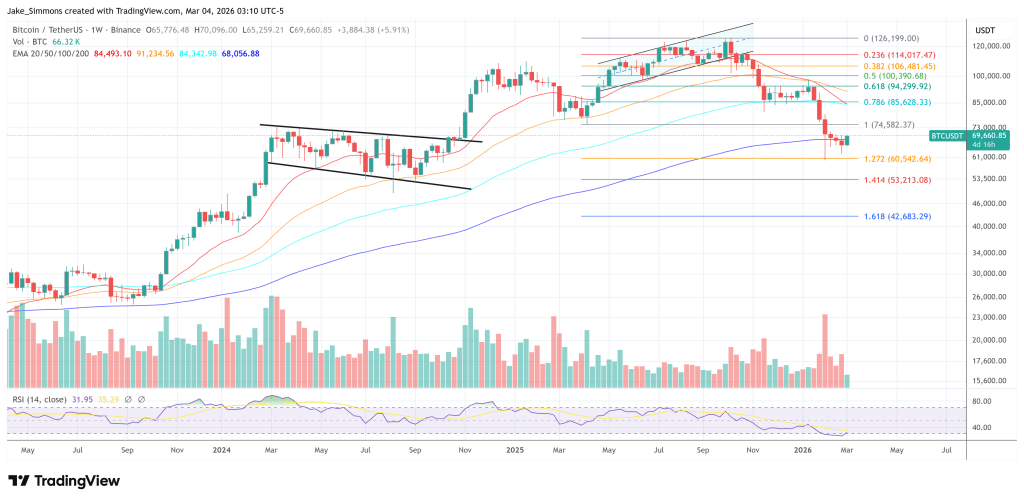

The cryptocurrency market was not spared from the fallout. Following the announcement, the total cryptocurrency market capitalization plunged by approximately 8%, falling to around $3.2 trillion in a single day. This drop mirrored losses seen in traditional equity markets.

But why would tariffs, which primarily affect trade and physical goods, cause such turbulence in the digital asset space?

The Ripple Effect on Cryptocurrencies

Even though cryptocurrencies operate independently of physical supply chains, their prices are often influenced by broader market sentiment. Several factors contributed to the sudden dip:

- Investor Risk Aversion: Institutional investors often hold both equities and crypto. When market shocks occur, they tend to de-risk across all asset classes, including cryptocurrencies.

- Stronger Dollar: Tariffs can strengthen the U.S. dollar as demand for the currency increases in global trade. A stronger dollar often puts downward pressure on risk assets, including crypto.

- Liquidity Constraints: In times of uncertainty, investors may liquidate crypto holdings to cover positions or rebalance portfolios, adding selling pressure to the market.

Economic Implications and Scenarios

Analysts are now evaluating the potential long-term impacts of these tariffs. Several scenarios could unfold:

Scenario 1: Stronger Dollar and Suppressed Crypto Prices

If tariffs lead to fewer imports in the U.S., this could reduce global access to dollar liquidity. In the short term, this would likely strengthen the dollar, suppressing crypto prices.

Scenario 2: Interest Rate Cuts and Market Rebound

Should economic conditions deteriorate due to inflation or reduced trade, the U.S. Federal Reserve might cut interest rates to stimulate the economy. Lower rates could be bullish for cryptocurrencies in the medium to long term.

Scenario 3: Geopolitical or Economic Shocks

Unforeseen events, such as a banking crisis or major geopolitical tensions, could either hurt or support crypto prices, depending on investor sentiment and policy responses.

The Importance of Risk Management

Given the volatile nature of both traditional and digital markets, investors must remain vigilant. Market shocks like these tariffs underscore the need for a diversified portfolio and robust risk management strategies. Cryptocurrencies, while promising, remain high-risk assets subject to sudden price swings.

Looking Ahead

The long-term impact of Trump’s tariffs on the cryptocurrency market is uncertain. What is clear is that economic and geopolitical developments will continue to influence investor sentiment and market dynamics. As nations navigate trade tensions and economic challenges, both traditional and digital markets are likely to experience turbulence.

In this unpredictable landscape, staying informed and adaptable is key. Whether you’re investing in equities or crypto, understanding the broader economic context will help you make better decisions and weather the storms ahead.