Bitcoin Price Could Exceed $800,000 with Trump’s Promise to Include BTC in US Strategic Reserves – Crypto Rover’s Bold Prediction

A Bitcoin specialist, Crypto Rover, expects that the cryptocurrency’s price will rise above $800,000 as a result of Trump’s promise to include it in the US’s strategic reserves.

In Donald Trump’s recent lecture at the Bitcoin 2024 conference in Nashville, he went all in on Bitcoin BTC $65,974, telling voters that the US will become “the crypto capital of the world.” He intends to accomplish this by establishing a national BTC “stockpile” and thereby converting the cryptocurrency into a “permanent national asset.”

Naturally, Trump’s campaign promises have elicited bullish replies from leading crypto analysts, with some forecasting that BTC’s price will skyrocket in the future.

Bitcoin price will certainly surpass $800,000 — Analyst

Daan de Rover, an independent market expert, has one of the boldest and most bullish outlooks for Bitcoin following Trump’s speech.

The chartist, known as “Crypto Rover” on X, believes BTC’s price would exceed $800,000 if the former US President is re-elected in November, especially since Trump has indicated that

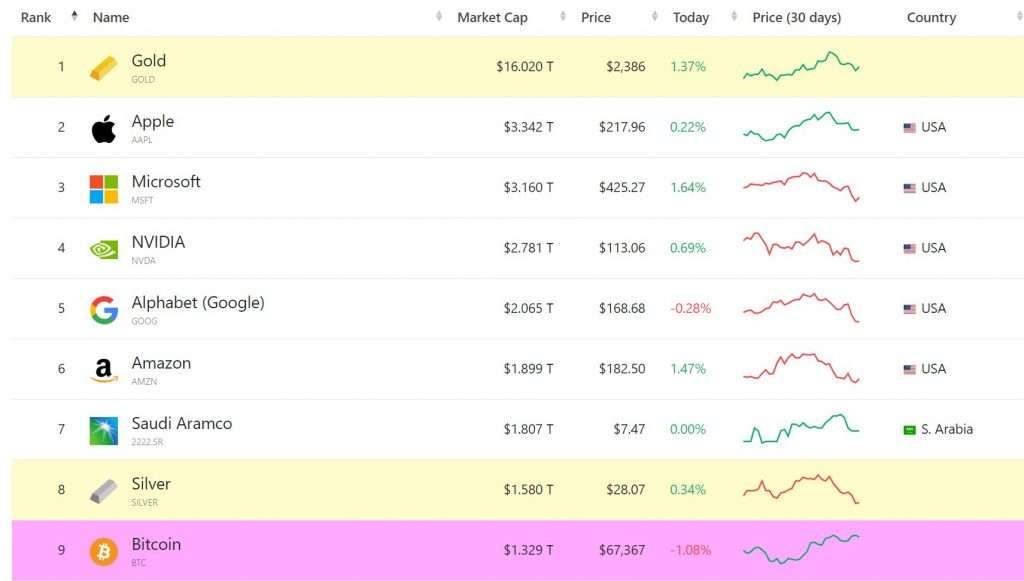

Bitcoin’s market valuation may eventually surpass that of gold.

“If this happened, BTC would be worth $813,054,” Rover wrote in a tweet on July 28.

Bitcoin vs. gold market capitalization. Source: Crypto Rover

Republican Senator Cynthia Lummis of Wyoming adds to the upbeat outlook. She proposed legislation to create an official US federal reserve of 1 million BTC over the next five years, which would be nearly 5% of the total BTC supply of 21 million tokens.

Here are some excerpts from her speech:

“Bitcoin will be held for a minimum of 20 years and can be used for one purpose: Reduce our debt.”

The US government already owns 210,000 BTC, worth more than $14.26 billion. Trump has committed to giving those interests to the US Treasury, stating that if elected, his administration will never sell them.

Analyst predicts Bitcoin price could hit $100,000.

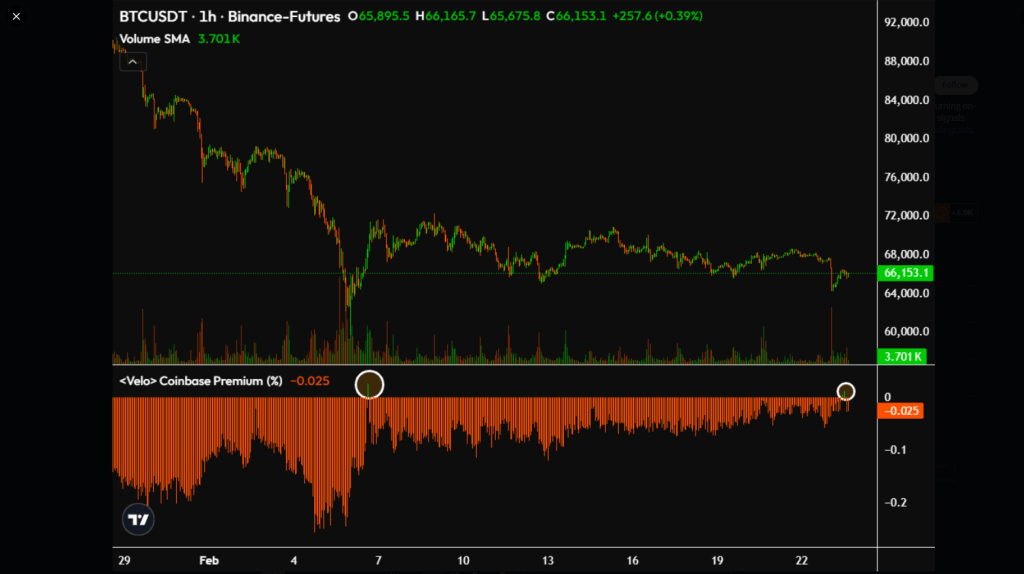

Bitcoin fell following Trump’s speech and has now stabilized around $67,500-68,000. However, this has not deterred certain analysts, such as Dan Crypto Traders and Tanaka, from making upward predictions toward $100,000.

“In the long term, I’m fully optimistic about BTC reaching $100k and ETH reaching $8-10k,” Kanaka stated, stressing that ETF funds will progressively “attract more large institutional investors” to the Bitcoin market.

As of July 26, US Bitcoin ETFs had $17.58 billion in assets, the largest total to date. This is also up from $14.65 billion at the beginning of the month, indicating a rise in interest in the days preceding Trump’s speech.

Meanwhile, Cryptomist predicts that the BTC price will hit $100,000, citing an ascending channel pattern.

Growing wedge: $74,000 is Bitcoin’s next target

Bitcoin’s wild price movements are occurring within the current rising wedge pattern, forecasting a climb to $74,000 by August. The wedge’s two trendlines converge at this level, which is 9.30% above current prices.

A definitive collapse below the wedge’s lower trendline, depending on the breakdown point, risks a decline to the $60,000-66,000 range. That is mostly due to the method used to generate rising wedge breakdowns: determining the maximum distance between the two trendlines and subtracting the result from the breakdown point.