Trump’s Crypto Shake-Up: What His First 30 Days Mean for Digital Assets

US President Donald Trump has wasted no time making waves in the cryptocurrency space, enacting policies and appointing key figures that signal a major shift for the industry.

One month into his presidency, Trump has introduced sweeping changes, many of which directly impact the cryptocurrency sector. His administration has welcomed several pro-crypto regulators, launched a controversial governmental efficiency department, and taken steps to reform oversight in the digital asset space.

Here’s a breakdown of the major crypto-related events that have unfolded during Trump’s first 30 days in office:

January 20 – A Crypto-Fueled Inauguration Day

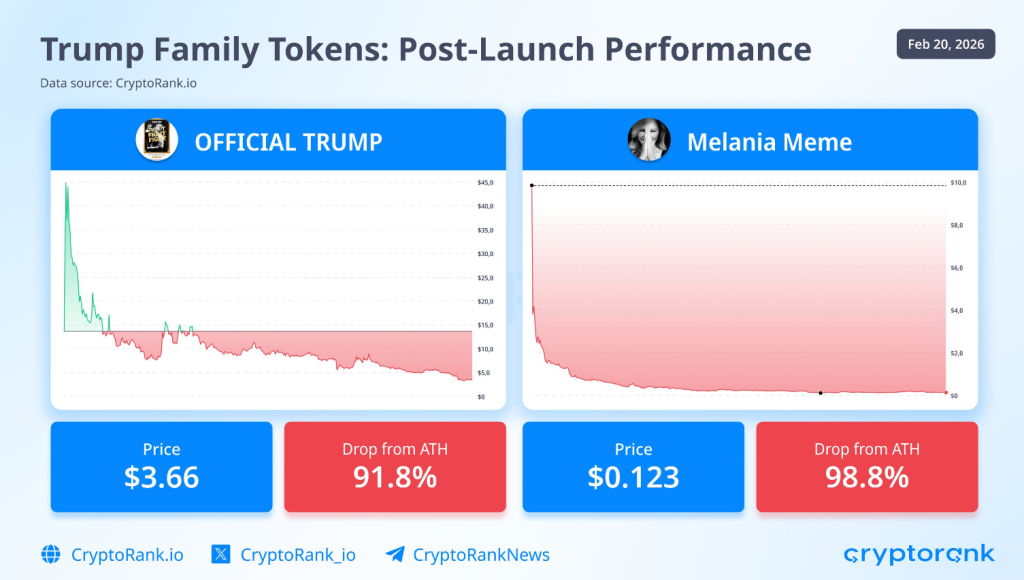

Trump’s inauguration day was eventful for the digital asset space. His administration launched World Liberty Financial (WLFI), a decentralized finance venture that made a massive $47 million investment in cryptocurrencies, bringing its total holdings to $326 million. Additionally, Trump introduced his own memecoin, TRUMP, on the Solana blockchain, which initially soared to a $15 billion market cap before experiencing a sharp 40% decline. Days later, First Lady Melania Trump followed suit with her own cryptocurrency, MELANIA.

January 20 – The Department of Government Efficiency (DOGE) Faces Immediate Legal Challenges

On his first day, Trump announced the creation of the Department of Government Efficiency (DOGE), an organization led by Elon Musk that aims to streamline government spending and restructure federal agencies. However, watchdog organizations immediately filed lawsuits, alleging that the formation of DOGE violated the Federal Advisory Committee Act (FACA) due to a lack of transparency and public involvement.

January 21 – SEC Leadership Overhaul and Crypto Task Force Formation

Fulfilling a campaign promise, Trump reshaped the Securities and Exchange Commission (SEC) by nominating Paul Atkins, a known crypto advocate, to replace Gary Gensler as SEC chair. While awaiting Senate confirmation, Mark Uyeda was appointed as acting chair, signaling a friendlier stance toward digital assets.

That same day, the SEC established a crypto task force led by pro-crypto Commissioner Hester Peirce. This group aims to clarify regulatory policies, create pathways for compliance, and reshape enforcement strategies.

January 22 – Silk Road Founder Ross Ulbricht Receives Presidential Pardon

Trump issued a pardon for Ross Ulbricht, the founder of the Silk Road marketplace, fulfilling a campaign promise to advocate for criminal justice reform in the crypto space. Ulbricht’s pardon was supported by libertarian groups and blockchain advocates who had long campaigned for his release.

January 23 – Executive Order on Crypto Policy and CBDC Ban

Trump signed an executive order establishing an internal crypto working group tasked with positioning the U.S. as a global leader in digital assets. The group will explore a national crypto reserve and regulatory framework but explicitly bans the creation of a U.S. central bank digital currency (CBDC). Notably, the order excludes the Federal Reserve and Federal Deposit Insurance Corporation (FDIC) from the initiative.

January 27 – Senate Confirms Pro-Crypto Treasury Secretary

Billionaire hedge fund manager Scott Bessent was confirmed as U.S. Treasury Secretary, further solidifying Trump’s pro-crypto stance. Bessent, known for his bullish views on Bitcoin and decentralized finance, pledged to support policies that encourage the growth of digital assets within the U.S.

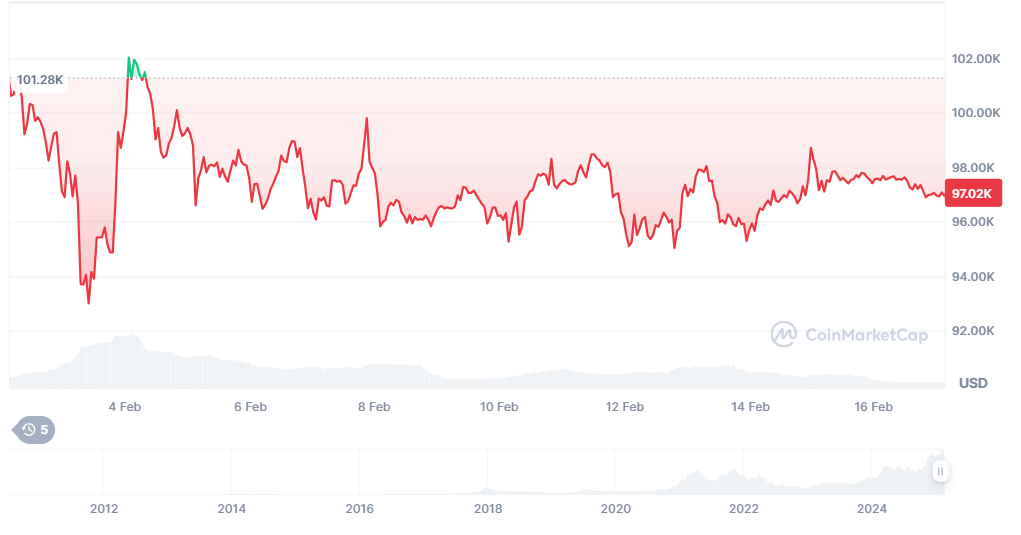

February 2 – Tariff Policies Shake Crypto and Traditional Markets

Trump imposed tariffs on Mexico, Canada, and China, causing volatility in traditional markets and cryptocurrency assets. Bitcoin saw a temporary downturn, highlighting its increasing correlation with macroeconomic policies.

February 3 – CFPB Leadership Shakeup

Trump dismissed Rohit Chopra, the head of the Consumer Financial Protection Bureau (CFPB), replacing him with Treasury Secretary Scott Bessent in an acting capacity. The move was widely seen as an effort to reduce financial oversight and encourage deregulation.

February 7 – CFTC Leadership Reshuffle

Commodity Futures Trading Commission (CFTC) Chair Rostin Behnam resigned, paving the way for a Trump appointee. A week later, Trump nominated Brian Quintenz, a former CFTC commissioner with ties to venture capital firm a16z, to take over the agency. His appointment is expected to favor crypto-friendly regulations.

February 9 – Bitcoin Dips Again Following Additional Tariffs

A fresh wave of 25% tariffs on steel and aluminum imports sent financial markets into another downturn, dragging Bitcoin along with it. Analysts predict continued volatility as Trump explores tariffs on European imports, semiconductors, and other critical industries.

February 12 – U.S. and Russia Conduct Prisoner Swap Involving Crypto Exchange Operator

The U.S. exchanged Alexander Vinnik, the former operator of crypto exchange BTC-e, for American teacher Marc Fogel, who had been detained in Russia. Vinnik had previously pleaded guilty to money laundering through BTC-e.

February 17 – DOGE Reportedly Targets the SEC

Reports indicate that DOGE, under Elon Musk’s leadership, is planning a major restructuring of the SEC, following previous shake-ups at other regulatory agencies. A Musk-affiliated X (Twitter) account hinted at plans to investigate inefficiencies within the agency.

February 19 – Pro-Crypto Commerce Secretary Confirmed

Billionaire Howard Lutnick was confirmed as Commerce Secretary after a 52–45 Senate vote. Lutnick’s financial firm, Cantor Fitzgerald, holds a stake in stablecoin issuer Tether, but he has pledged to divest his private investments within 90 days.

What’s Next for Crypto Under Trump?

Trump’s first month in office has set a clear trajectory for crypto-friendly policies and deregulation. His appointments and executive orders signal an intention to foster U.S. crypto leadership, possibly through stablecoin legislation and state-level crypto reserves.

With Congress exploring new regulatory frameworks, the next steps for the Trump administration will likely shape the future of blockchain adoption, institutional investment, and crypto market stability in the U.S.