The price of Bitcoin is trapped in a downward trend because sellers aren’t willing to let up.

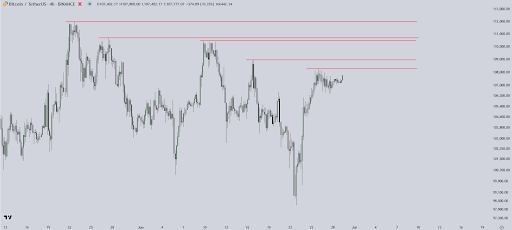

The price of Bitcoin (BTC) has been trading between $55,000 and $58,200 for almost a week, with the 200-day exponential moving average (EMA) at $58,000 acting as a resolute resistance. The price of BTC is currently ticking down at $62,875.80.

Lower trading volumes and a protracted period of consolidation are suggested by the price of Bitcoin, which is currently trading at $57,841, up 0.36%, according to the online data.

Let’s examine the causes of the current price stagnation of bitcoin.

The 200-day EMA is weighing down the price of Bitcoin

The price of bitcoin dropped below the 200-day EMA’s crucial support on July 4 due to the German government’s continuous selling and the anticipation of Mt. Gox’s repayments.

There have been multiple attempts to recover the mentioned level, but none of them have succeeded in igniting a wider price movement. Instead, according to independent trader and expert Jelle, BTC has been “chopping” below this “key SR area” for the past seven days.

In a post on X on July 11, fellow analyst Daan Crypto Trades stated, “Bitcoin is progressing well along the roadmap.”

With the help of recent market movement, Bitcoin has recovered to $56,500, a crucial level to maintain in order to reduce the “danger for more immediate downside.”

“Now fighting the big battle with the Daily 200MA/EMA & Range low,” said Daan Crypto Trades.

According to FireCharts published by trading resource Material Indicators, Bitcoin Whales bought into a block of ask liquidity below the 200-day EMA throughout the decline. Based on Material Indicators, a strong candlestick above this level would indicate strength among the buyers.

“I’d like to see BTC Bulls push past the 200-day MA and the 21-day MA in one Daily candle to show a sign of strength. Failure to do so would be a sign of weakness.”

Whales of Bitcoin keep piling up

The recent decline hasn’t affected bitcoin whales, who see it as a chance to increase their holdings. The Bitcoin Accumulation Trend Score is 0.444, indicating that investors are accumulating more, according to Glassnode data given by independent trader Ali Martinez.

The relative magnitude of entities that are actively accumulating coins on-chain in terms of their BTC holdings is shown by the Accumulation Trend Score. When the score is positive, it means the whales are taking in more Bitcoin than they are giving out; when it is negative, the converse is true.

Glassnode claims that the trend score surge reflects a shift in nearly all cohorts from distribution to accumulation. This trend is consistent with an accumulation pattern seen in October 2023, prior to Bitcoin’s extraordinary increase from $25,000 to $49,000, which was sparked by the introduction of spot Bitcoin exchange-traded funds.

Data from CryptoQuant, which indicates that inflows into accumulation addresses surged on June 10 in response to Bitcoin’s decline below $54,000, supports this accumulation.

There is still no volatility in the price of Bitcoin

In terms of past volatility, Bitcoin is still at an all-time low. According to CryptoQuant, trading activity has slowed down overall since April, as investors who are taking profits anticipate a bigger spike in the future.

As of July 11, the historical volatility index for Bitcoin, according to TradingView data, was 8.86, a significant drop from its peak of 42.7 in 2021.

Conclusion

The present state of the Bitcoin market, where the price seems to be trapped in a small range, is depicted by all these elements. Onchain measures should be regularly monitored by market participants to stay informed, nevertheless, as changes always happen extremely quickly.