It’s four-plus months into 2021, and DeFi is blowing the top. There are no signs of slowing down. Since the beginning of the year, DeFi has tripled in total value locked, rising from $15 billion to $45 billion. The drastic increase shows its potential to keep growing well into the near future.

It has always been like the boom and bust in the financial markets. Began in summer 2020, the “degen finance” made its presence felt. Some parts of the cryptocurrency community were alarmed about the unpleasant and portentous warnings of the ICO era.

Remember the Yam Finance debacle that has undergone a dramatic boom and bust within 24 hours? On the other hand, we saw “food finance” trending to hit the space. These kinds of cycles are already a known phenomenon in the financial market. Perhaps, financial institutions assumed that DeFi might mark a similar negative line on the financial markets. However, we don’t need to rush right away to decide on what it will it be like with DeFi, the decentralized finance.

Bitcoin traces back to!

Bitcoin remained the first decentralized currency to run on blockchain technology. It brought a great revolution and laid the foundations for future cryptocurrency. Fast forward to 2021, today we are here with thousands of cryptocurrencies rolling out.

Although Bitcoin remains strange and mysterious until 2014 or 2015, it became the primary digital currency that steered us towards the digital currency revolution. Once the ICO poured a lot of money into the crypto space, for the first time, Bitcoin’s value skyrocketed and grabbed the attention of investors and fintech enthusiasts. Then began the era of cryptocurrency and investments.

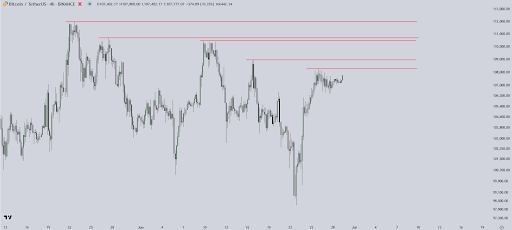

Investors have shown their willingness towards crypto investments seeing the potential of the crypto and the technology behind it. As a result, Bitcoin drew maximum momentum and hit a high price today.

Centralized entities move-in

After the decentralization space getting craze from across the world, centralized entities are seen showing interest in DeFi. The centralized institutions started integrating the DeFi concept into their services and solutions. This is evidently found when Binance started offering staking and lending services.

Binance has been the pioneer among the centralized crypto firms, launching its smart contract platform, the Binance Smart Chain, which has become the hub for DeFi projects, and PancakeSwap becoming the first billion-dollar project on the Binance Smart Chain.

Well, a few other firms took a unique approach to integrate the DeFi. Centralized exchange Huobi and DeFi lending platform Kava announced a significant integration release.

DeFi: The Future

We are already hearing various centralized projects lined up that are integrating with DeFi. For instance, Trance Network is an exciting project as it is merging DeFi with NFTs and real-world use cases in trade finance and retail. NFTs can offer an immutable, unique proof of ownership for luxury products; designer handbags or high-end watches are a few among them. The DeFi makes it possible to fill the gaps and break down the financial barriers to create an easy path between partner firms.

We also see DeFi bridging the regulatory gap. For instance, the Chicago DeFi Alliance was established due to the collaboration of Chicago trading firms and members of the DeFi community.

All of this shows a great sign of DeFi and the bestowed future to the financial markets. We might also see a full-on integration of DeFi into plenty of other sectors. History will be glowing again – similar to Bitcoin, DeFi will make us proud.