UK to Enforce Comprehensive Crypto Transaction Reporting from 2026: What It Means for the Industry

In a decisive move toward greater oversight of the digital assets sector, the United Kingdom will begin requiring crypto firms to collect and report detailed customer transaction data starting January 1, 2026. This mandate marks a significant regulatory milestone as the UK aligns itself with international standards for crypto tax transparency.

Announced by HM Revenue and Customs (HMRC), the new rule compels UK-based crypto platforms to maintain records for every transaction conducted on their services. This includes full user information—such as name, residential address, and tax identification number—as well as specifics of the transaction like asset type and amount. Entities such as trusts, companies, and nonprofits engaging in crypto transactions will also fall under the reporting scope.

The consequences for non-compliance are notable, with penalties reaching up to £300 per affected individual. While further guidance is expected from HMRC in the coming months, the government is encouraging firms to begin preparing their data infrastructure now.

A Global Trend Toward Tax Clarity

This move is part of the UK’s adoption of the OECD’s Crypto-Asset Reporting Framework (CARF)—a global initiative designed to bring digital assets in line with existing tax reporting mechanisms for traditional finance. By standardizing how crypto transactions are reported across jurisdictions, CARF aims to close tax gaps and reduce opportunities for evasion.

The UK’s approach reinforces a growing sentiment among global regulators: crypto is here to stay, and it must operate within the same guardrails as the rest of the financial system.

“Britain remains open for innovation and business, but the message is clear: abuse, fraud, and loopholes will not be tolerated,” said Chancellor Rachel Reeves, who also introduced draft legislation to tighten regulation of crypto intermediaries in late April.

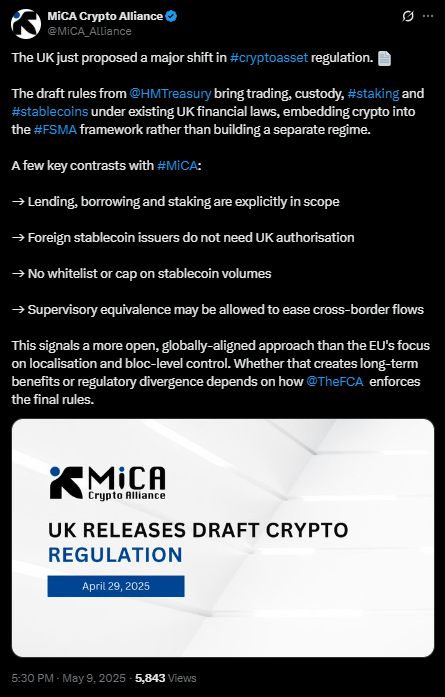

UK vs EU: Diverging Regulatory Strategies

While the UK integrates crypto into its existing financial and tax framework, the European Union has taken a more structural route with its Markets in Crypto-Assets (MiCA) regulation. One standout difference: the UK will allow foreign stablecoin issuers to operate without domestic registration, a contrast to the EU’s more restrictive stance that includes potential volume caps on stablecoin circulation.

This signals that the UK may be positioning itself as a more agile and innovation-friendly destination for crypto firms—particularly those facing regulatory friction in other regions.

Rising Adoption, Rising Scrutiny

The new regulations also come amid a sharp increase in retail crypto adoption in the UK. According to the Financial Conduct Authority (FCA), 12% of UK adults held some form of cryptocurrency in 2024, up from just 4% in 2021. With adoption growing, so too does the need for consumer protection, tax enforcement, and institutional accountability.

Looking Ahead

For the crypto industry, the UK’s decision presents both a challenge and an opportunity. Firms will need to bolster their compliance infrastructure and adopt more rigorous data handling practices. But in return, they may benefit from a more stable and trusted environment that encourages institutional engagement and mainstream growth.

In a world where regulatory clarity is fast becoming a competitive advantage, jurisdictions that move decisively—while supporting innovation—stand to lead the next chapter of digital finance.