Bitcoin Adoption: Still in Its Early Stages — Here’s Why

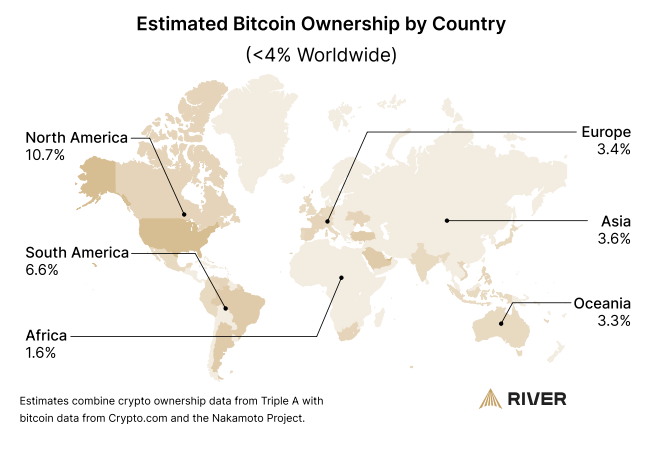

Despite Bitcoin’s growing popularity in the financial world, only 4% of the global population currently holds Bitcoin (BTC), according to a recent research report from River, a Bitcoin financial services company.

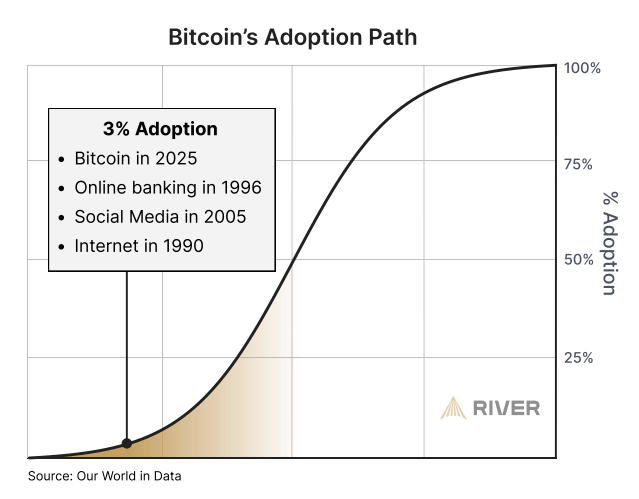

Bitcoin’s adoption path is still only at 3%. Source: River

Who Holds Bitcoin Today?

The United States leads global Bitcoin ownership, with an estimated 14% of Americans holding BTC. North America remains the continent with the highest adoption rate, both among individuals and institutions. By contrast, Africa shows the lowest adoption, with just 1.6% of individuals owning Bitcoin.

The report highlights a clear trend: Bitcoin adoption is higher in developed regions compared to emerging economies, signaling that the cryptocurrency’s potential has yet to be realized in much of the world.

How Far Along Is Bitcoin’s Adoption?

Interestingly, River estimates that Bitcoin has achieved only 3% of its total adoption potential — meaning there’s still 97% of untapped market potential.

Estimated Bitcoin ownership by geographic region. Source: River

This figure is based on an analysis of Bitcoin’s total addressable market (TAM) — which includes individuals, corporations, institutions, and even governments. Within that market, institutional underallocation and low individual ownership rates keep Bitcoin adoption far from maturity.

Although Bitcoin has made significant progress — even being considered as part of US government reserves — it remains in the early stages of global acceptance.

What’s Holding Bitcoin Back?

1. Lack of Education & Awareness

One of the biggest barriers to Bitcoin’s mass adoption is a lack of financial and technical education. Many people still harbor misconceptions, mistakenly believing Bitcoin to be a scam or Ponzi scheme. Without accessible education on how Bitcoin works and its potential use cases, widespread adoption remains difficult.

2. Volatility and Market Fluctuations

Bitcoin is notoriously volatile, which makes it appealing to short-term traders, but problematic as a medium of exchange or store of value. This volatility especially impacts residents in developing countries, where people are often seeking stable alternatives to their own unstable local currencies.

3. Preference for Stablecoins in Developing Economies

In many developing economies, particularly in Latin America, stablecoins have overtaken Bitcoin as the digital asset of choice for everyday transactions. A 2023 report from Chainalysis revealed that stablecoins — not Bitcoin — are the most widely transferred digital assets in these regions.

Stablecoins offer lower transaction fees and price stability, making them a more practical solution for people looking to avoid currency devaluation and financial instability.

4. Regulatory Pressures and Geopolitical Dynamics

Regulation remains a double-edged sword for Bitcoin. While clearer guidelines could boost adoption, aggressive regulation could limit its growth. Recently, during the White House Crypto Summit on March 7, US Treasury Secretary Scott Bessent announced that the United States will leverage stablecoins to maintain US dollar dominance as the global reserve currency. This indicates that government’s focus may lean toward stablecoins over decentralized cryptocurrencies like Bitcoin, adding further uncertainty for BTC’s future trajectory.

The Road Ahead for Bitcoin

Although Bitcoin adoption has grown steadily, reaching 3% of its maximum potential shows that the journey is just beginning.

For Bitcoin to move closer to mass global adoption, key steps must be taken:

- Widespread education to dispel myths and misunderstandings.

- Improved infrastructure to reduce volatility and enable smoother transactions.

- Balanced regulation that protects consumers without stifling innovation.

Bitcoin’s potential as a decentralized, borderless form of money remains powerful — but unlocking that potential will require overcoming significant hurdles.

Final Thought

As Bitcoin continues to mature, investors, institutions, and governments will need to navigate its risks and opportunities carefully. For now, mass adoption remains a work in progress, and the next few years will be critical in shaping Bitcoin’s role in the global financial system.