The decentralized finance (DeFi) sector is experiencing an unprecedented decline in market dominance, slipping below 3%—a level not seen since early 2021. While this might seem like a sign of stagnation, history suggests that such dips often precede a resurgence.

With major investors concentrating on Bitcoin (BTC) and Ethereum (ETH), DeFi tokens have largely been overlooked. However, this downturn could offer a strategic entry point for long-term investors eyeing undervalued assets.

DeFi Market Share Hits a Multi-Year Low

According to recent data from Alphractal, DeFi’s share of the overall crypto market has dropped below 3%, marking a significant milestone. The last time dominance reached this level, DeFi witnessed an explosive rally as capital rotated from BTC into undervalued altcoins.

The current market structure mirrors past cycles, where Bitcoin’s dominance peaks before altcoins catch up. Investors who positioned themselves during the last downturn saw exponential gains as DeFi rebounded. Could we be on the brink of another shift?

Opportunities Hidden in the Market Downturn

Several established DeFi projects, including Chainlink (LINK), Hedera (HBAR), Avalanche (AVAX), Uniswap (UNI), and Aave (AAVE), continue to maintain strong fundamentals despite the sector’s broader decline. The fading hype has left these projects undervalued, creating potential opportunities for accumulation.

Key market trends influencing DeFi:

- Regulatory clarity: The SEC’s recent decision to drop its appeal against a ruling that exempted DeFi platforms from securities laws may pave the way for greater institutional participation.

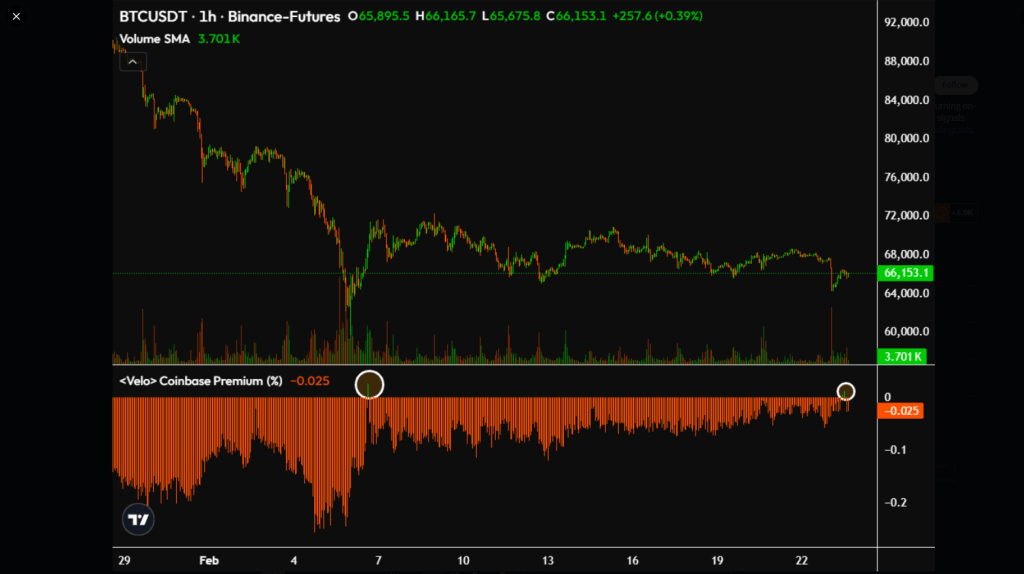

- Bitcoin ETF outflows: With BTC exchange-traded funds witnessing over two weeks of consecutive outflows, investors may seek alternative high-growth opportunities like DeFi.

- Protocol evolution: New developments continue to push DeFi forward, despite lower dominance in the market.

DeFi Projects Pushing Forward

Even as market sentiment remains cautious, DeFi projects are actively innovating:

- Hemi Labs launched its mainnet with over $440 million in Total Value Locked (TVL), offering interoperability between Bitcoin and Ethereum.

- Converge, an upcoming Ethereum-compatible blockchain, is set to introduce native KYC and custody solutions, making it attractive for institutional adoption.

- INFINIT Terminal is simplifying DeFi interactions through AI-powered, text-based agents designed to enhance user experience.

Meanwhile, high-profile DeFi ventures are still securing major funding. World Liberty Finance, a DeFi initiative backed by former U.S. President Donald Trump, recently raised $550 million in token sales, reflecting sustained investor interest in the sector.

Final Thoughts: A Time to Accumulate?

DeFi’s falling dominance might look like a weakness, but it could also be a signal for patient investors. History has shown that when market attention is focused elsewhere, undervalued sectors tend to bounce back stronger.

With continuous innovation, increasing regulatory clarity, and undervalued assets, DeFi may be gearing up for a new growth phase—offering opportunities for those willing to look beyond short-term trends.