The Future of Finance: How DeFi is Redefining Market Dynamics

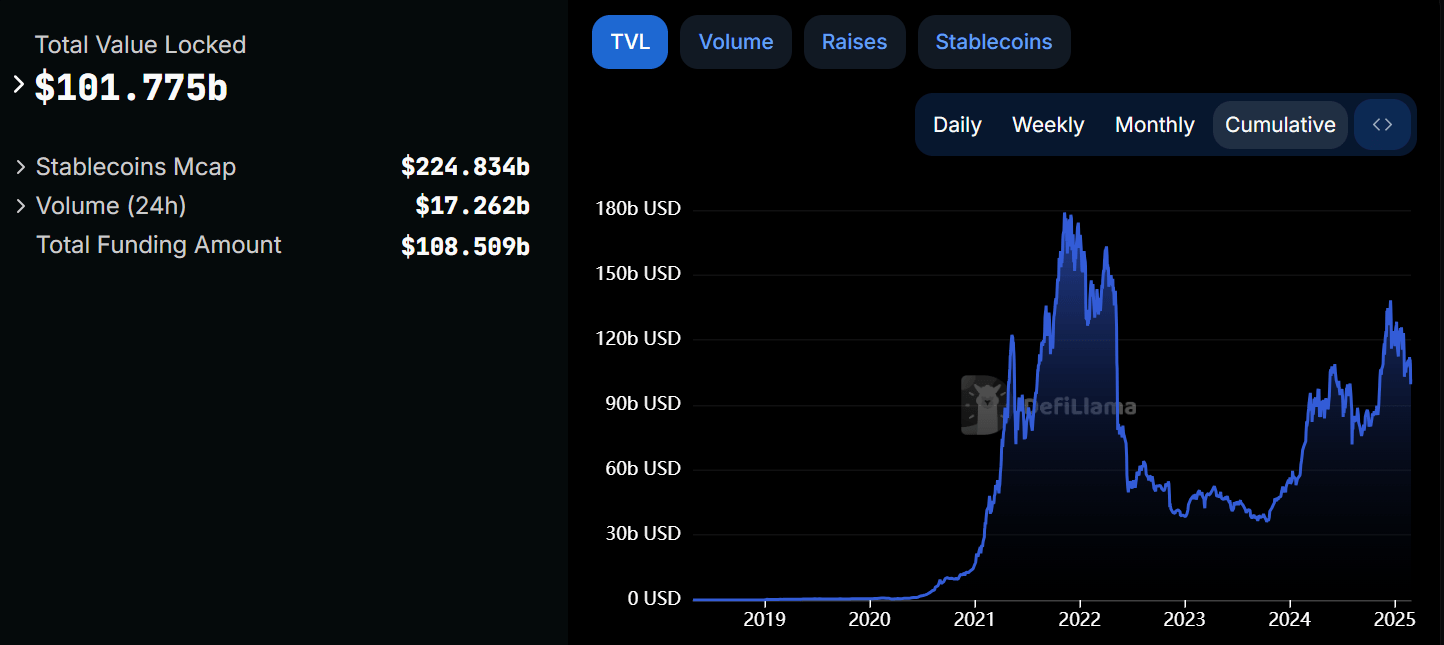

The financial landscape is undergoing a massive transformation, with decentralized finance (DeFi) emerging as a groundbreaking alternative to traditional banking systems. This new financial model prioritizes accessibility, transparency, and user empowerment, offering a level playing field for participants across the globe. As DeFi continues to evolve, its potential to reshape market dynamics, challenge conventional institutions, and redefine the principles of capitalism is becoming increasingly evident.

A New Era of Financial Inclusion

DeFi introduces a paradigm shift by eliminating intermediaries and granting users direct control over their financial assets. Unlike traditional finance, which relies on banks, brokers, and regulatory bodies, DeFi operates through decentralized applications (DApps) and smart contracts. These self-executing protocols facilitate transactions, loans, and asset management without requiring approval from centralized authorities.

One of the most compelling aspects of DeFi is its accessibility. Anyone with an internet connection can participate, regardless of their geographic location or financial background. This democratization of financial services fosters greater inclusion and empowers individuals who have historically been excluded from the global banking system.

Breaking Free from Traditional Constraints

Traditional financial institutions often impose strict requirements and barriers to entry. Whether it’s high fees, lengthy approval processes, or geographical restrictions, these limitations hinder economic participation. DeFi, on the other hand, offers a frictionless alternative where users can trade, lend, borrow, and earn yields without bureaucratic interference.

Furthermore, DeFi is built on transparency. Every transaction is recorded on a public blockchain, ensuring accountability and reducing the risk of fraud. This level of openness starkly contrasts with traditional finance, where opaque practices and institutional favoritism often dictate market outcomes.

Challenges and Risks in the DeFi Ecosystem

Despite its numerous advantages, DeFi is not without its challenges. Security remains a major concern, as vulnerabilities in smart contracts can be exploited by malicious actors. Additionally, the rapid growth of the sector has led to regulatory scrutiny, with authorities worldwide debating how to implement oversight without stifling innovation.

Another challenge is volatility. Many DeFi projects rely on cryptocurrencies, which are known for their price fluctuations. This can introduce risks for users seeking stable financial solutions. To mitigate these issues, ongoing development and security audits are crucial, along with the adoption of decentralized governance models that prioritize user protection.

The Regulatory Landscape and Its Impact on DeFi

As DeFi gains traction, regulators are increasingly looking to establish guidelines for the industry. In some jurisdictions, authorities are attempting to apply traditional financial regulations to decentralized platforms, which could limit their potential. Striking the right balance between oversight and innovation will be critical to ensuring DeFi’s long-term success.

Countries that adopt progressive regulatory frameworks stand to benefit the most, attracting entrepreneurs and developers looking for a supportive environment. Conversely, restrictive policies may drive DeFi projects to relocate to more favorable jurisdictions, shifting the global epicenter of financial innovation.

The Future of DeFi and Capital Markets

DeFi represents more than just a technological advancement—it’s a shift toward a more open and equitable financial system. By decentralizing power and promoting self-sovereignty, it aligns with the principles of a free market while introducing unprecedented levels of efficiency and accessibility.

Moving forward, the challenge lies in refining DeFi’s infrastructure to enhance security, usability, and compliance without compromising its core values. If successful, DeFi has the potential to redefine capital markets, making them more resilient, transparent, and inclusive than ever before.

As financial technology continues to evolve, one thing remains clear: DeFi is not just a passing trend. It’s a fundamental shift that has the potential to reshape the future of global finance.