AI Agents to Lead the DeFi Industry — But Where Do the Wallets Stand

DeFi is rapidly entering a new era powered by autonomous AI agents. But as these agents grow more capable, the very wallets meant to secure them are proving to be DeFi’s weakest link. Without robust, programmable infrastructure, DeFi is at risk of becoming a playground for unchecked automation and financial vulnerabilities.

AI Agents Never Sleep — Unlike Human Traders

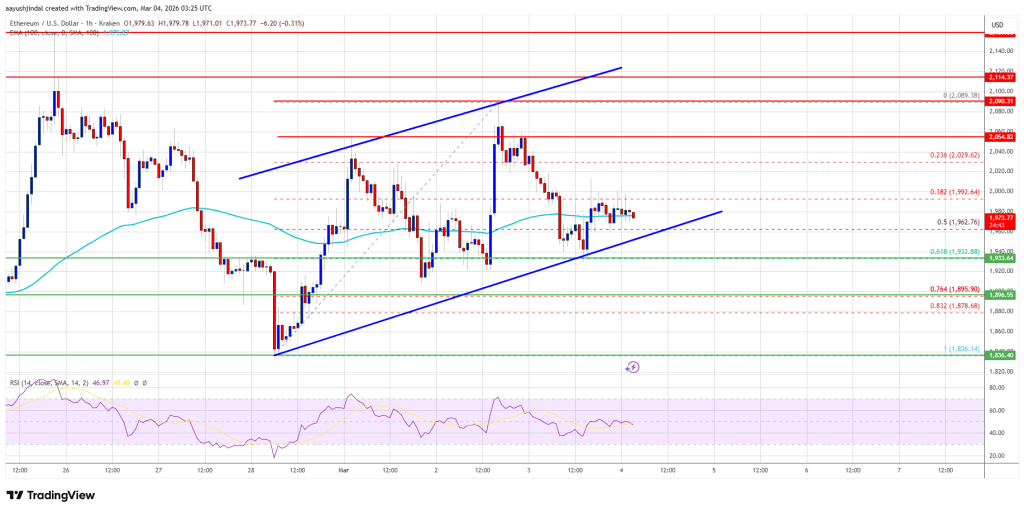

The crypto market operates around the clock, and AI agents are stepping in to fill the human gap—managing liquidity, optimizing yields, and executing trades in real-time. What started as tools for quant-savvy users are quickly turning into critical infrastructure. Yet, most DeFi activity still depends on basic, manually controlled wallets.

Smart contract wallets and account abstraction are promising steps forward, but they remain fragmented, expensive (especially on layer-1 networks), and largely unused by the broader user base. As automation becomes the norm, the need for a secure and programmable wallet infrastructure becomes urgent.

Automation Needs Guardrails, Not Blind Trust

Autonomous agents open doors to hands-free DeFi: automated rebalancing, cross-chain arbitrage, and smarter yield farming. But without on-chain verifiability and controlled permissions, these benefits come with serious risks.

Recent exploits are proof. In September 2024, a vulnerability in the Banana Gun trading bot led to a loss of 563 ETH (nearly $1.9 million). Just weeks later, a breach at Aixbt caused a $100,000 loss when hackers gained control over its trading dashboard. These aren’t one-offs — they highlight an industry-wide lack of infrastructure suited for intelligent automation.

Why Legacy Wallets Are Holding DeFi Back

Wallet technology hasn’t kept pace with AI. Most wallets simply execute transactions — they don’t interpret user intent, verify agent behavior, or support conditional logic like time-based access or strategy-specific restrictions.

This binary setup — full manual control or complete trust in third-party bots — leaves users exposed. For agent-based DeFi to truly scale, we need wallets that support granular permissions, composability, and real-time verification.

Programmable Permissions: The Future of User Trust

Just as smart contracts power DeFi protocols, wallet infrastructure must evolve to encode trust and control. This means enabling features like session-based access, cryptographic proofs of agent behavior, and instant access revocation.

These programmable tools don’t just enhance safety — they also expand DeFi’s reach. With clear, enforced boundaries, users without deep technical knowledge can still tap into advanced AI-managed strategies, securely and confidently.

Scalable Infrastructure for a Multichain DeFi World

Secure, programmable wallet infrastructure isn’t just about risk mitigation — it’s also the key to DeFi’s long-term scalability. A unified keystore layer that manages permissions across chains could unlock seamless, cross-chain automation and pave the way for interoperable AI agent ecosystems.

As institutional players eye DeFi, verifiable control systems will be non-negotiable. Just as zero-knowledge proofs are becoming standard for privacy and compliance, programmable permissions will become essential for autonomous security.

The Road Ahead

Skeptics may warn against giving AI financial autonomy — but traditional finance has already embraced algorithmic trading and automation. The difference is that TradFi built the infrastructure first.

If DeFi wants to uphold transparency, sovereignty, and security, it must do the same. That starts by reimagining wallets as dynamic control hubs for the multichain, AI-powered economy.

The automation wave is coming. The question is not whether AI agents will be involved — it’s whether we’ll equip them with the safeguards needed to serve users, not exploit them.