Trump’s Crypto Reserve Plan Sparks Backlash – What’s Fueling the Divide?

Including Solana (SOL), Cardano (ADA), and XRP in the US crypto reserve is attracting skepticism within the industry.

The skepticism emerges from President Donald Trump’s announcement, including the lesser-known tokens in the US crypto reserve plans. Investors question the merits of this move, pointing to the fact that the selected coins are quickly surrendering their weekend gains.

Crypto Reserve Announcement

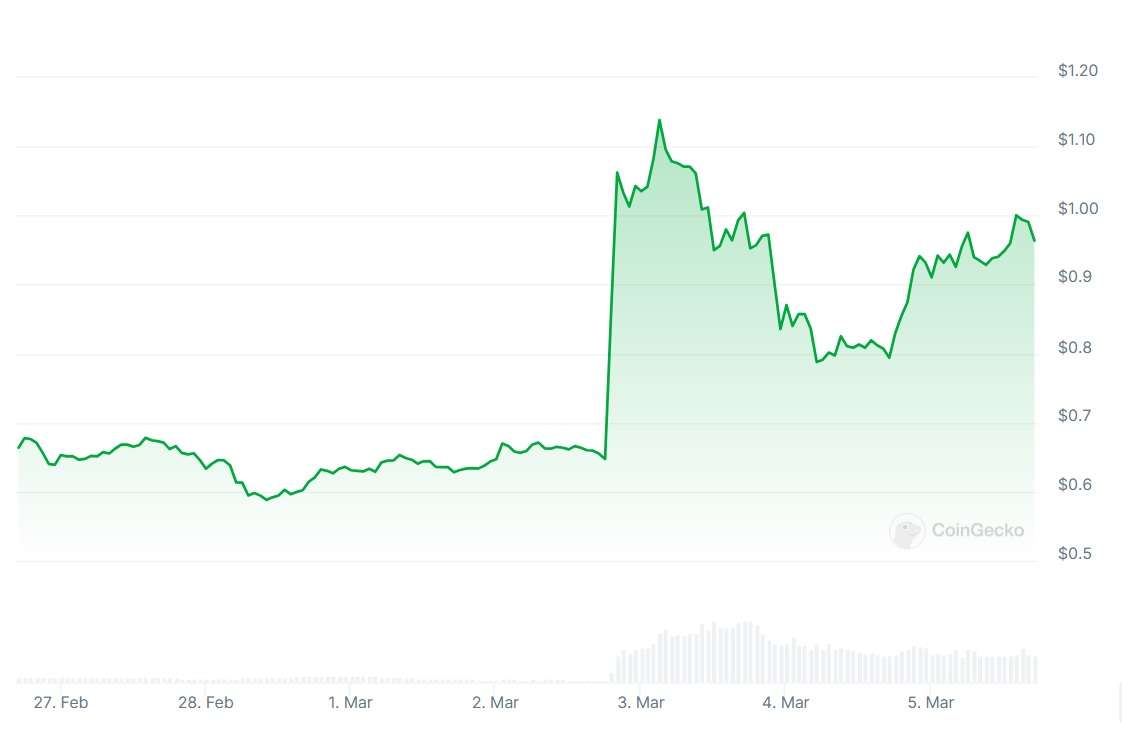

The concerns emerge from the Truth Social post by Trump outlining that SOL, XRP, and ADA tokens would join Ether and Bitcoin in the highly anticipated crypto reserve. While Bitcoin enthusiasts opposed their addition, the announcement ignited a market-wide wild rally lifting most crypto asses from their worst month-long downtrend since 2022.

The initial excitement has vanished, plunging the crypto market into a bloodbath, with Bitcoin retracing to a low of $80,123.98 on Monday morning. CoinGecko data shows that at press time 08:52 AM (UTC), Bitcoin is 5.0% down to trade at $81,589.23 as the crypto market records a 6.9% intraday loss to a $2.77 trillion value.

By Monday evening, following the reserve announcement, the crypto market had lost its bullish steam as investors questioned the feasibility and underlying motivations for adding lesser-known tokens to the reserve plan. This saw the altcoins retreat, with XRP, SOL, ETH, and ADA each registering intraday declines above 10% to surrender their previous gains.

Declined Awareness of Value Proposition

Critics liken the strategic reserve to a retail trader’s portfolio in 2017 as they decry inadequate awareness of the true value proposition of cryptos. Some consider the move to have emerged from the pressure Trump experienced witnessing the February downturn despite the huge campaign donations and endorsement from the crypto community vote.

The downturn hit the industry hard despite the US Securities and Exchange Commission’s (SEC) move to ease the long-standing crackdown on crypto projects and firms. Notably, the SEC dropped lawsuits involving Coinbase, Gemini, OpenSea, Cumberland DRW, Yuga Labs, Kraken, Consensys, and Robinhood, besides pauses to ongoing cases involving Binance and founder of Tron blockchain Justin Sun.

While the easing by the SEC is a monumental policy shift, it has failed to avert the selloff that market analysts attribute to concerns regarding trade tariffs targeting China, Mexico, and Canada. As such, Bitcoin slid into the red zone, dragging along XRP, SOL, and ETH, each losing 13%.

Is Lobbying Involved?

Meanwhile, the recent announcement differs from the initial plan in January to establish a crypto reserve, which the White House reiterated to derive a stockpile from crypto lawfully seized during enforcement efforts. Bitcoin is the only crypto seized during the authorities’ crackdown targeting the Silk Road platform. The absence of detail during the January announcement disappointed investors, setting the stage for the selloff witnessed in February.

The mention of altcoins in the reserve plans coincided with the White House preparations for crypto czar David Sacks to host the initial industry summit. Interestingly, before assuming office, the March 7 event host declared selling all crypto holdings, including BTC, SOL, and ETH. The inclusion of XRP is unsurprising given that last month, Trump referenced a CoinDesk article that featured Ripple Labs head Brad Garlinghouse. This is a testament to its newfound political access following a multi-year legal battle with the SEC over XRP classification.

Market observers are concerned about the motive to include XRP, ADA, and SOL and question their qualifications. Despite the early promise of Ripple developing a distributed ledger for mainstream financial services, the adoption of this technology is minimal.

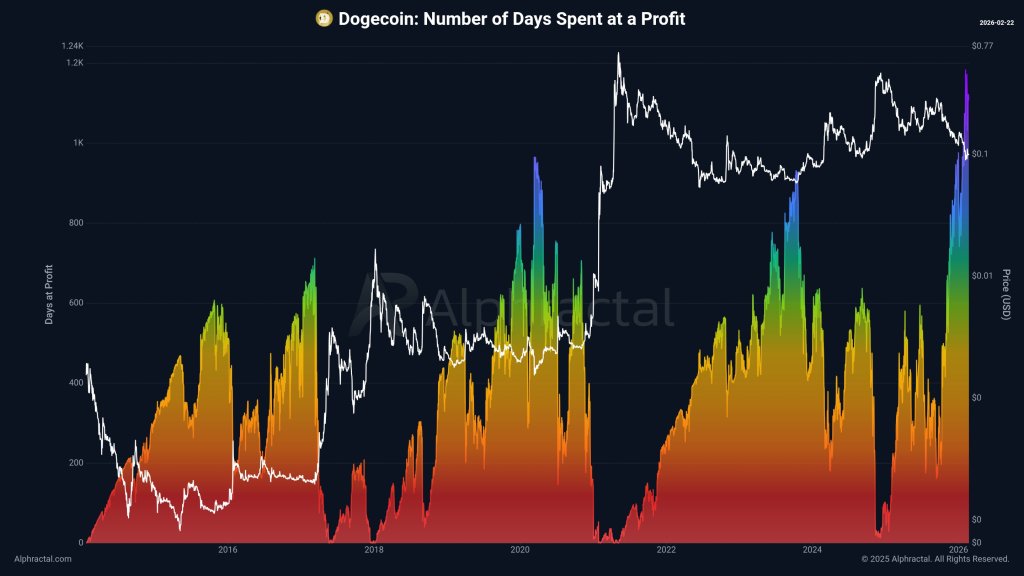

Additionally, Solana is identified as a meme-coin platform, leaving it vulnerable to price movements relative to social media trends. Trump and wife Melania unveiled meme coins on the Solana. The Official Trump (TRUMP) token has plunged 85% from Jan’s peak of $73.43 to exchange hands at $$11.07. This prompts concerns over SOL token inclusion, as it lost 56.4% of its value from $293.31 on Jan 19 to trade at $127.81 per CoinGecko data.

Cardano: A Difficult Sell?

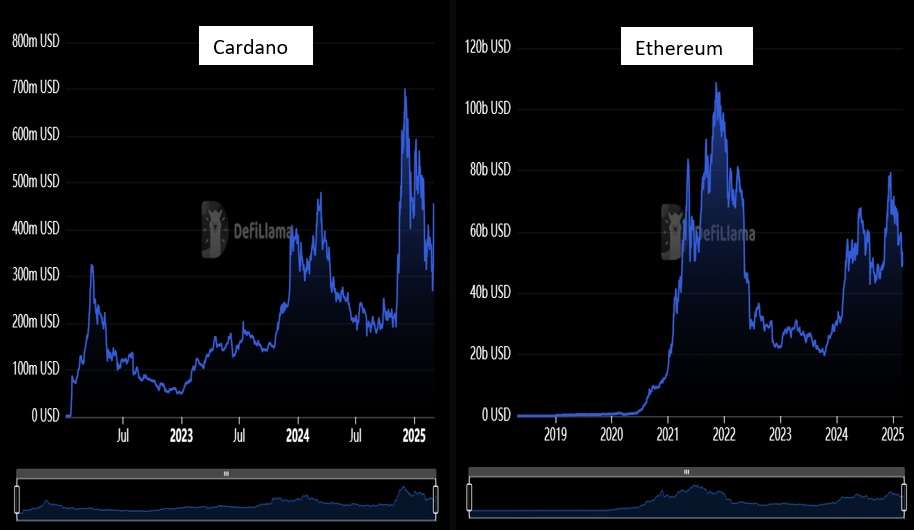

Cardano, whose developers portrayed it as rivalling Ethereum, is struggling to gain a foothold in decentralized finance (DeFi). Scrutiny into the metrics furthers the skepticism on whether Cardano meets the high standards required to feature in the same conversation as Bitcoin and Ethereum.

Venture Fund Head, David Nage, assessed Cardano’s credentials to ascertain whether it meets the standards demanded of the reserve asset. In his scrutiny, the total value locked of Cardano’s DeFi was $418.1 million, which is in sharp contrast to Ethereum’s $50.909 billion per DefiLlama.

Furthermore, Cardano’s active addresses in the value locked are 39,276, barely accounting for 10% of Ethereum’s towering 398,598. Scrutiny into the Cardano’s activity shows the active addresses hit a 320,000 peak during the 2021-22 bull run only to slump below 100,000 per IntoTheBlock data. The decline hints at a struggling network to regain activity levels, inviting concerns about whether the present ADA price reflects the true adoption. This proves Cardano’s ecosystem is relatively small enough to warrant a seat among potential alternatives to gold’s successors in reserve assets.

Backlash from Industry Heavyweights

The proposal by President Trump for the strategic crypto reserve to include various digital assets has drawn considerable backlash from his supporter base. Gemini’s co-founder Cameron Winklevoss expressed doubts about the ADA, XRP, and SOL, stating that extending the list beyond Bitcoin is unsuitable. As a prominent figure in the industry, Winklevoss’ criticism highlights the division despite his recent support for Trump’s bid last year.

The recent foray into the crypto reserve, including altcoins, raised eyebrows among Trump’s crypto backers advocating for Bitcoin. They view BTC as athe more stable investment that could rival the gold.

Venture capitalist Joe Lonsdale expressed discontent over allocating taxpayers’ money to high-risk crypto assets lacking proven value. David Sacks defends the proposal, labelling the conclusions prematurely without knowing the full details. Diem co-creator David Marcus disputes this narrative, indicating only Bitcoin meets the criteria for a strategic asset. This implies that spending taxpayers’ funds on low-value tokens is inappropriate.

Why This Matters

The backlash meted by investors and industry executives question the inclusion of crypto assets that appear decentralized in name only.

Placing the metrics of each asset under a microscope supports the fundamental questions raised by those opposed to broader reserve initiatives. The metrics reveal a significant disparity between the market reality and political designation for the crypto selection for strategic reserve assets.

The substantial improvement needed for the ADA metrics confirms the doubts key industry figures expressed about expanding the reserve initiative beyond Bitcoin.

The backlash that meted out towards including XRP, ADA, ETH, and SOL implies that convincing Congress that they are stores of value could prove a problematic sell, unlike Bitcoin, as the new digital gold.